Collusive Oligopoly and Non-Collusive Oligopoly |Characteristics of Oligopoly Market

What is an Oligopoly?

An oligopoly is an imperfectly competitive market structure consisting of a few large firms that sell identical or differentiated products. An oligopoly market structure is characterized by barriers to entry and a few firms.

Oligopoly is a fascinating market structure due to interaction and interdependency between oligopolistic firms. What one firm does affects the other firms in the oligopoly.

Characteristics of Oligopoly Market Structure

Key characteristics of oligopoly market structure is a market which describes a situation in which:

- Firms are price makers.

- Few but large firms exist.

- There are close substitutes.

- Non-price competition exists in the form of product differentiation.

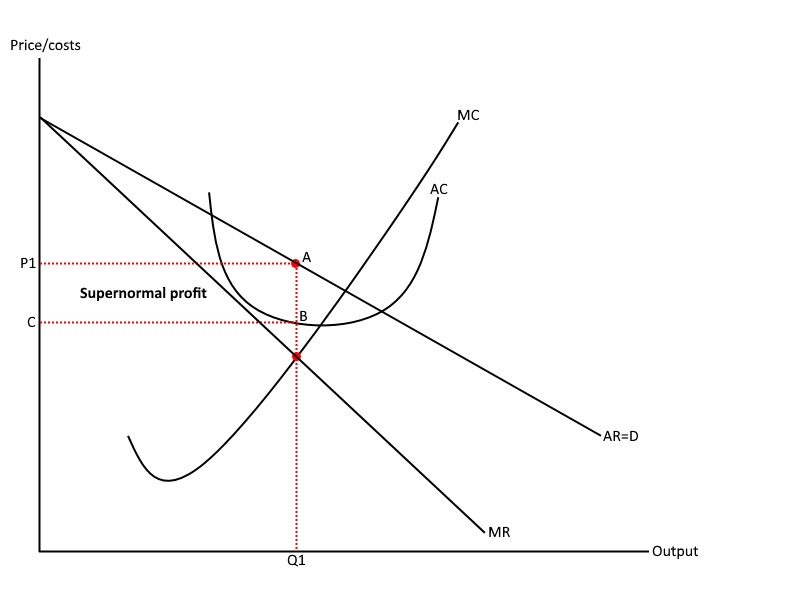

- Supernormal profits re-earned both in the short run and long run.

Because the sellers are few, then sellers’ decisions are mutually interdependent, and they cannot ignore each other because the actions of one will affect the others.

Pricing and Output Decisions of The Firm

The price and output shall depend on whether the firm operates in a Pure oligopoly or Differentiated oligopoly.

Pure Oligopoly

Oligopolists normally differentiate their products. But this differentiation might either be weak or strong.

Pure oligopoly describes the situation where differentiation of the product is weak. Pricing and output in a pure oligopoly can be collusive or non-collusive.

Collusive Oligopolies

What is Collusive Oligopoly?

Collusive oligopoly refers to a market where there is co-operation among the sellers, i.e., coordination of prices.

Types of Collusive Oligopoly

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

There are two types of collusive oligopoly. They are ;

- Formal Collusive Oligopoly

- Informal Collusive Oligopoly

Formal Collusive Oligopoly/ Cartel Model of Oligopoly

Formal Collusive oligopolies are where the firms come together to protect their interests.

Example of Formal Collusive Oligopoly/ Cartel Model of Oligopoly

Cartels like OPEC. In this case, the members enter into a formal agreement by which the market is shared.

The single decision-maker will set the market price and quantity offered for sale by the industry. A central agency sets the price and quarters produced by the firms and all firms aside by the central agency’s decisions.

The maximized joint profits are distributed among firms based on the agreed formula.

Informal Collusive Oligopoly

Informal collusive oligopoly can arise into two cases, namely:

- The cartel is not possible, maybe because it’s illegal or some firms don’t want to enter into an agreement or lose their freedom of action completely.

- Firms may find it mutually beneficial for them not to engage in price competition. When an outright cartel does not exist, firms will collude by covert gentlemanly agreement or spontaneous co-ordination designed to avoid the price war’s effects.

One such means by which firms can agree is by price leadership. One firm sets the price, and the others follow with or without understanding. When this policy is adopted, firms enter into a tacit market sharing agreement.

Price leadership model of Oligopoly

There are two types of price leadership, namely:

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

- By a low-cost firm

When there is a conflict of interests among oligopolists arising from cost differentials, the firms can explicitly or implicitly agree on sharing the market. The low-cost firm sets the price. We can assume that the low-cost firm takes the biggest share of the market.

- Price leadership by a large firm

Some oligopolists consist of one large firm and several smaller ones. In this case, the larger firm sets the price and allows the smaller firms to sell at that price and then supply the rest of the quantity.

Each smaller firm behaves as if in a purely competitive market where the price is given, and each firm sells without affecting the price because each will sell where MC = P = MR = AR.

Non-Collusive Oligopolies

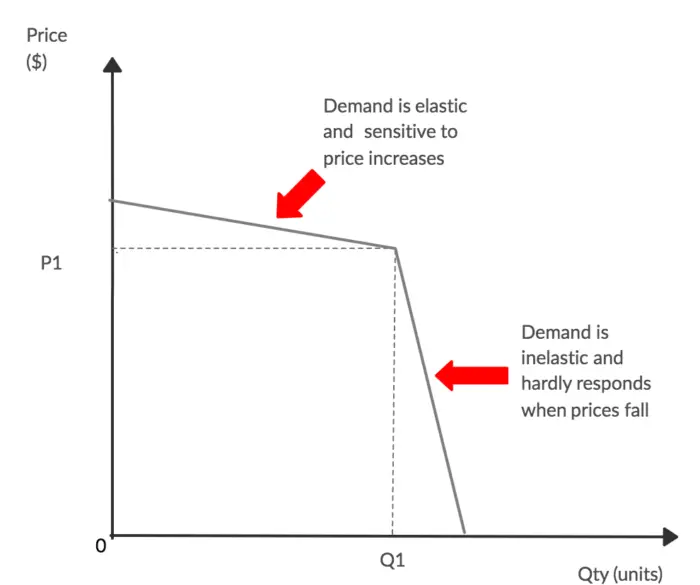

Non-collusion oligopolies operate in the absence of collusion and a situation of great uncertainty. In this case, if one firm raises the price, it is likely to lose a substantial proportion of customers to its rivals.

They will not raise the price because it is interested in charging a price lower than their rivals. If the firm lowers the price, it will attract a large proportion of customers from other firms. The other firms are likely to retaliate by lowering prices either to the same extent or a large extent.

The first firm will retaliate by lowering the price even further. As the firms will always expect a counter-strategy from rival firms, each price and output decision the firms develop is a tactical move within a broader strategic framework. This then leads to a price war.

If it goes on, there will come a time when the prices are so low that if one firm lowers the price, the consumers will see no point in changing from their traditional suppliers. Thus, the demand for the individual firm’s product will start by being elastic, and it will end by being inelastic.

Thus, the demand curve for the individual firm’s product consists of two parts: the elastic part and the inelastic part. It is said to be a “kinked‟ demand curve, as shown below.

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

If the firm is on the inelastic part and raises the price, the others will not follow suit. But on this part prices are so low that is likely to retain most of its customers. If it raises prices beyond the kink, it will lose most of its customers to rivals.

Hence the price p will lose most of its customers to rivals. Hence the price p will be the stable price because prices are unstable in that rising price means a substantial loss of customers, and lowering price may lead to a price war. Below P prices are considered to be too low.

Barriers to entry in Pure Oligopolistic Market Structure

The barriers to entry can be artificial or natural. Artificial Barriers can be acquired through:

- State protection through issuance of the exclusive market (franchise) licenses and patent rights.

- Control of supply of raw materials

- The threat of price war, if financial resources can sustain losses temporarily, the cartel or price leader can threaten the new entrant by threatening to lower prices sufficiently to scare new firms.

Difference Between Collusive Oligopoly and Non-Collusive Oligopoly

Difference |

Collusive Oligopolies |

Non-Collusive Oligopolies |

| Definition of Oligopolies | Collusive oligopoly refers to markets with co-operation among the major sellers, i.e., coordination of prices. Collusion can be Formal or Informal. | Non-collusive oligopoly refers to markets where there is no co-operation among the major sellers in the industry. They operate in the absence of collusion and a situation of great uncertainty. |

| How they work | Collusive oligopolies are markets where sellers attempt to eliminate the competition through a formal agreement with other firms. | Non-collusive oligopolies are a form of market where each seller has its own pricing strategy and output policy to outcompete its rivals. |

| Price Wars in oligopolistic market | Because of Collusion, there are no many price wars as they sell at agreed prices. | There are intense price wars among the players. Any price reduction will lead to other firms following suit to retain the market shares. |

| Profit Maximization in oligopolistic market | Firms can collude and set very high prices to maximize profits and sales. | There is no much a seller can do on prices. They focus on other strategies like branding, quality, etc. ad a means to profit maximization. |

| Formations of oligopolies | Collusive oligopolies are monopolist that creates a cartels markets to eliminate competition and control the market share. | Non-collusive oligopolies could be formed when there is State protection through issuance of the exclusive market, control of raw materials, or market leader trying to outperform new entrants in the market. |

Differentiated Oligopoly Characteristics

Some oligopolistic industries produce identical products, like perfect competition in this regard, while others produce differentiated products, more like monopolistic competition.

Differentiate Product Oligopoly: This type of oligopoly tends to focus on goods sold for personal consumption. The key is that people have different wants and needs and thus enjoy the variety.

Example of differentiated oligopolistic

A few examples of differentiated oligopolistic markets include automobiles, household detergents, and computers.

Related: Prebisch Singer Hypothesis Economics

Advantages and Disadvantages of Oligopolistic Market Structure

Advantages of Oligopolistic Market Structures

- Competitive oligopolies non-collusive oligopolies often lead to a price war. This often in lower prices for the consumers

- When firms have huge supernormal profits and are taxed, they result in huge tax revenues for the day’s government.

- The few large firms can benefit from economies of scale hence lower cost of production.

- Competition for market share often results in improved product quality in order to win over the customers.

Criticism/ Disadvantages of Oligopoly Market structure

- In a collusive oligopoly, the formations of cartels by leading firms make it difficult for new entrants to get into the market.

- Because of high prices in a collusive oligopoly, consumers often pay more than the product’s values and leads to exploitations.

- In an oligopolistic market, barriers to entry and exit are high.