Ansoff Matrix Product Development Strategy

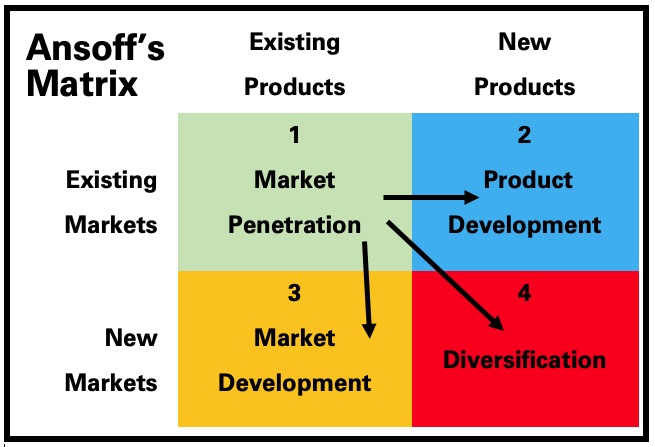

The Ansoff Matrix, is also referred to as the Product/Market Expansion Grid is an important strategy tool used by organizations to analyze and plan key strategies for growth. The strategy matrix was first developed by H. Igor Ansoff, renown applied mathematician and business manager and was published in 1957 in the Harvard Business Review (HBR). The Ansoff Matrix has helped many executives and marketers to better understand the risks inherent in growing their business.

Ansoff strategy analyzes potential growth strategies based on the extent to which new products and or new markets are sought.

-

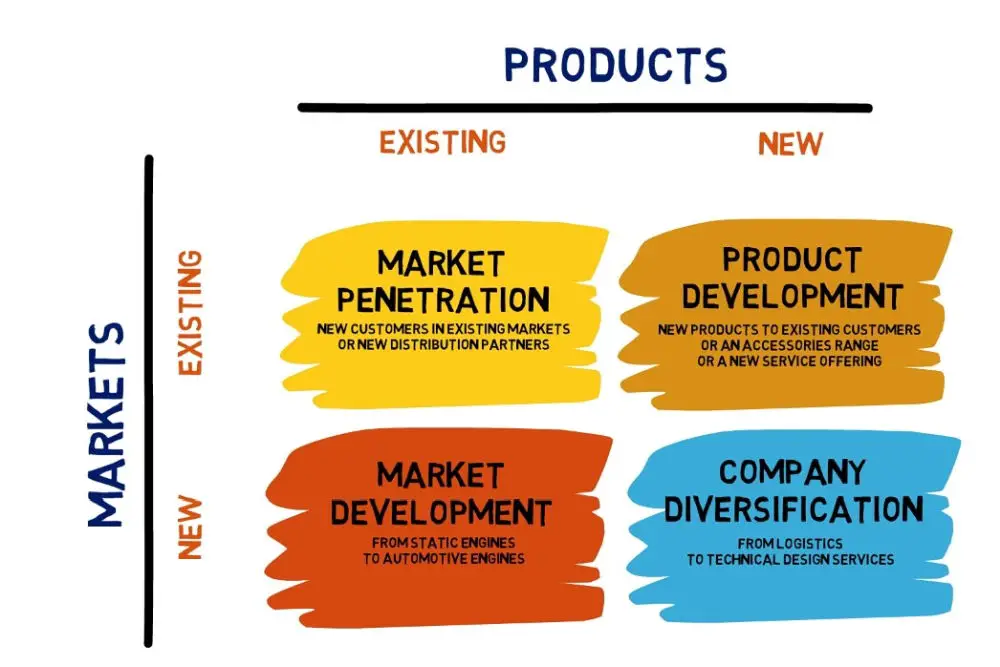

Market Penetration

Current products and current markets. It involves achieving wider adoption of an existing product by the existing target customers.

There are three ways in which a company can penetrate a market.

- Stimulating customers to increase the current usage rate by increasing customer purchase units, speeding up the rate of product improvement/obsolescence suggesting new uses for the product, and offering price incentives for increased usage. For example, the frequent flyers club offered by KLM and KQ to loyal customers to encourage them to increase bookings. After a certain mileage, the customers get a free ticket.

- Attract non-users through promotions.

- Swing competitors’ customers through brand differentiation. This is appropriate when:

- When the overall market is growing or can be induced to grow, and therefore it is relatively easy to gain market share.

- If the firm holds a strong market position and is able to use its experience and competencies to obtain strong, distinctive competencies/competitive advantages.

- This strategy requires a relatively lower level of investment with a corresponding risk reduction.

-

Product development

Offering new products to the present market and by developing this strategy, the company could:

- Develop new product features by attempting to modify, adapt, magnify, or combine existing features.

- Create different quality versions of the product.

- Develop additional models and sizes.

The reasons why a company may opt for this strategy are:

- It holds a high relative market share, has a strong brand presence, and enjoys a distinctive competitive advantage in the market.

- There is growth potential in the market.

- The changing needs of the customers demand new products. Continuous product innovation is often the only way to prevent product obsolescence.

- It needs to react to technological developments.

- The firm is particularly strong in research and development.

However, this strategy has its downside, especially in the line of expense and risk.

3. Market Development

The process by which the firm seeks new markets for its current products. There are many possible approaches:

- a) New geographical areas and export markets, e.g., a radio station is a new transmitter to reach a new audience

- b) New distribution channels.

- c) The company may try attracting other market segments through developing product versions that appeal to them, e.g., travel companies have developed a market for cheap stay long winter breaks in warmer countries for retired couples.

4. Diversification

When a company decides to make new products for new markets. The company gets involved in activities that differ from those in which it is currently involved. The company selectively changes the product lines, customer targets, and manufacturing and distribution arrangements.

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

Diversification can either be related or unrelated.

Related Diversification Strategy

Related Diversification Strategy is a development beyond the present product market but still within the industry’s confines. It, therefore, builds on the assets or activities which the firm has developed. It takes the form of vertical or horizontal integration: – development into activities that are competitive with or directly complementary to a company’s present activity(ies).

Vertical integration: – occurs when a company becomes its own supplier or distributor. It can either be backward or forward.

Related Diversification Strategy Examples

Honda Motor Company is an excellent example of leveraging a core competency by using related diversification strategy. Honda is well known for its trucks and cars but the organization began motorcycle business area. Through competing in this business, Honda developed a unique ability to build small and reliable engines. When executives decided to diversify into the automobile industry, Honda was successful in part because it leveraged this ability within its new business. Honda also applied its engine-building skills in the all-terrain vehicle, lawn mower, and boat motor industries.

Other examples is CocaCola Company and have utilize the strategy well.

Advantages of Related Diversification Strategy

- A secure supply of components or materials hence lower supplier bargaining power.

- A stronger relationship with the final consumer can be built.

- Share of profits at all the stages of the value chain.

- Creation of barriers to entry and therefore deter competitors.

Disadvantages of Related Diversification Strategy

- Over concentration in one area. Should the industry fail, the whole company suffers.

- Failure to reap the benefits of economies of scale in the industry in which it has diversified.

Unrelated Diversification Strategy

Unrelated Diversification Strategy or conglomerate is a development beyond the present industry into product/markets which, at face value, may bear no close relation to the present product/market.

Advantages of Unrelated Diversification Strategy

- Risk spreading: – entering new products into new markets offers protection against the failure of current products or markets

- High-profit opportunities: -stability in profits because if there are hard times in one industry, they offset others’ losses.

- Better access to capital markets because of the large size ―big is mighty.

Disadvantages of Unrelated Diversification Strategy

- Lack of common identity and purpose and could affect the focus of the firm.

- Failure of one business drags down the rest.