What Inflation Rate is & Impacts of High Inflation on Businesses

Inflation rate can be defined as the rate at which the general level of prices for goods and services are going up and as a result, the buying power of currency is falling. We can also say that the inflation rate is the percentage change in the price level from one year to the next.

Deflation rate on the other hand is when the price level is falling and the inflation rate is negative.

How to calculate inflation Rate

Measuring inflation is a little bit more complex because, at any one time, there are millions of products and services available in an economy. And tens of thousands of those might be rising in price, and tens of thousands of those might fall in price on millions of them might be staying static in terms of that price.

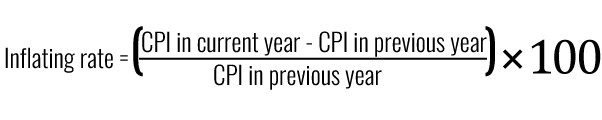

How to calculate inflation Rate with Consumer Prices Index (CPI)

To try to measure inflation as a whole across an economy, the government uses a system known as the Consumer Prices Index (CPI)

And with CPI, they pick out 600-700 of the most commonly bought stables, most commonly purchased goods and services by most households, and that includes a whole range of groceries, products that we might consume during our leisure time, a number of our most common household bills or expenditures.

And it tracks what it calls this basket of 600- 700 different items and tracks whether those products and services are rising in price or whether they’re falling in price.

Even in this basket of 600 or 700 different goods and services, some of the prices will be rising while and others falling

What they do is they measure the basket is a whole aunt. How much the price of that basket of 600 or 700 different groceries and leisure activities and household expenditures? They measure how it has grown or increased compared to the last measurement of the basket and goods.

When we hear news reports saying that inflation has increased by 2%, what that means is this basket of goods that the government tracks through its CPI, its price had increased by 2% compared to when it was measured previously.

Is Inflation Good or Bad?

Often, we assume that inflation or price rises are bad, that they’re a negative thing, both for the economy and for businesses. That’s not necessarily the case.

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

Why is Inflation Good

Inflation can actually be seen as a relatively positive sign of the health of the economy. Because if prices are rising in the economy, then it indicates that both consumers and businesses have confidence in how the economy is developing.

Firms are confident in increasing their prices when they feel that the economy’s outlook and future are exceptionally bright.

They might increase their prices because they have confidence that the economy will continue to grow over the next 6 to 12 to 18 to 24 months. That it might be quite vibrant that consumers will remain confident enough to go out and spend their money to loosen their purse strings and buy goods and services. When we have inflation in the economy is a sign of health.

Inflation Problems

The problem comes when inflation actually grows too rapidly when prices in the economy begin to rise too quickly.

That’s a problem because of the relationship between goods and services‘ prices on people’s incomes, wages, and salaries.

When inflation is taking place inside an economy, inflation is happening quite slowly. If prices are perhaps rising by one or 2% per year, people’s incomes can rise at that same kind of level.

Even though we might be going to the shops and the prices of what we want to purchase might have increased if we’ve experienced increases in our own pay packets by 1 or 2% as well.

And it means that we can continue to sustain the same standard of living that we’ve been enjoying previously. If the prices of what we want to buy increase by 2.5%, but we’re getting annual pay rises of 2.5% or more then we can sustain, perhaps even improve the standard of living we’re experiencing.

The problem is that people usually only achieve pay rises once per year, but firms can increase their prices whenever they like.

So, if people are receiving, say a 23% pay rise, but then prices in the economy of next year start to increase by 4-5 or even more percentage points, then it means that people’s incomes are not rising as rapidly as prices are inside the economy.

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

That means people can’t afford to sustain the same standard of living, and that’s when inflation can become difficult for consumers and, as a knock-on consequence, may become difficult for firms.

High Inflation Rate

A high inflation rate in an economy basically means when the prices inside the economy a rising faster than people’s incomes are, it means that businesses have some decisions from situations that they might find themselves in.

Effects of Inflation (High Inflation Rate)

High Inflation Rate Increases in cost & Product increase Prices

First, it is about costs. When there is inflation in the economy, it’s not only us as consumers that are experiencing price rises; it will firm as well.

These could be costs in terms of the raw materials that they purchased, or their energy prices that the firms are to pay could even be in terms of their labor force.

Firms have a very difficult decision to decide what to do with their own prices if they’re experiencing rising costs and option one is to keep their prices the same because they don’t want to pass those price rises onto consumers.

They know that perhaps due to the price elasticity of what they sell, it might be harmful to them to increase their prices any further, and so the firm will have to keep its price.

When its own cost is increasing on, find that its profit margins on each of its sales will be squeezed.

The alternative for firms is if they’re experiencing their own cost rises because of inflation in the economy, then they may decide to adjust for that by increasing their own prices.

High Inflation Rate Reduce Demand for the Product

As the firm starts to experiencing rises in their own costs, they can decide to pass that on to consumers. But then they are risking, depending on the price elasticity. They are risking damaging the demand for their goods and services. They may see drop-offs in sales volume and will find that their capacity utilization figures start to dwindle.

They might even find that if rivals are taking different measures to them, perhaps leaving their prices the same, they might maybe experience falls in their market share, which might affect their economies of scale that they may be benefiting from.

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

That’s a real critical decision for firms during periods of high inflation.

- What’s happening to the firm’s own costs?

- Are we going to account for that by perhaps trimming our profit margins?

- Or are we going to try and account for that by-passing price rises on to consumers?

Critical decisions for firms when inflation is running quite hot, regardless of what firms do with their prices, even if they keep them the same during periods of high inflation, firms may well experience a fall in demand.

You’ve got to imagine that during periods of high inflation, it’s really affecting consumers. Suppose the prices of what they purchased are greater than the wages or the salary increases they might be receiving. Consumers will have to start making rational judgments and decisions and sacrifices. In that case, there may be things that they choose to trim from their expenditure.

Businesses that are selling things that perhaps less of a necessity and more of a luxury, more of indulgence might find that even during periods of inflation if they keep their prices precisely the same because consumers are finding that their own incomes are not stretching this far, there may be things that they trim from expenditures, which mean firms start to experience a full in demand.

New Salary Negotiations with Employees

When inflation starts to run quite high, and it goes to 3% to 4%, or 5% is quite common than for those workers or their representatives in the form of trade unions, you want to open negotiations with employers and start demanding pay increases

when the standard of living of workers starts to dwindle because prices are rising fast in their incomes, it means that they want to start opening negotiations to bargain for greater pay rises.

Again, businesses have a crucial decision to make here either they have to agree to these pay rises. That’s going to increase their labor costs, increasing the organization’s costs.

That brings them back to think whether they will pass on to consumers or risk damaging the firm’s industrial relations. And perhaps damaging or weakening the relationship with the employee about salary increases will have to keep to the agreed salary increases that we’d already put in place on.

As workers, I’m afraid you will have to experience but drop in your living standards, and you’re going to have to bear the brunt of the price rises in the economy. That is a problematic situation for firms to navigate.

The question is, are we going to try to maintain the cost that we’ve already got that potentially tarnish that relationship that we might be trying to foster with the employees in our organization?

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

High Inflation Rate Effects on Markets of Operations

Another decision for firms during periods of inflation is to do with the markets they’re operating in because, remember, when we’ve got high levels, inflation, for instance, in the UK economy doesn’t mean that they are replicated in other nations throughout the world. It might be that there are other markets that firms could try and target, prioritize more, where price levels are actually far more stable, and why they might have some inflation.

It might be more predictable, and it’s rising at the same kind of rate as Incomes the economy.

It will help during periods of high inflation in the UK; other markets become more attractive to the firm than they might seek to export more to these markets because their inflation patterns are more stable and predictable than they are in the UK.

Affects Businesses Strategies

Another thing is businesses and their strategies. Some businesses might think about expansion plans and growth and investment in new capital expenditure projects.

Those firms that have been planning to invest in machinery, new plants, new factories, new facilities may be new equipment, new vehicles, flesh in and price rises perhaps rising quite quickly, really inject some indecision into that decision making four firms, they’ve got to decide it;

- Do we want to act quite quickly because of the prices of things arising quite fast?

- Do we want to try and force through growth and investment?

- What do we actually want?

- Cancel plans for growth and investment?

High Inflation Rate on Plans for Future Investment

Another decision for firms and their managers is to continue with their investment plans, but try and force it through quickly before prices rise even further?

Or do they shelved those plans while they wait to see how the economy continues to develop on whether they wait to see whether there’s the demand continuing for their goods and services to make any growth and investment worthwhile?

Inflation has a significant impact on businesses. There is a greater impact on some than others, depending on the organization’s size, the industry that is the price elasticity of what they sell.

But we can see that it can create some real problems for businesses about the timings of decisions, the types of decisions that they’re going to make, whether they’re going to experience increases in cost or whether they’re going to experience falls and demand as they increase that prices.

Inflation is a real trigger for organizations to think about their strategies on planned decisions about how they will deal with inflation and how it’s will impact their consumers.

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.