Kinked Demand Curve Oligopoly | Concentration Ratio of Oligopoly

Characteristics of oligopoly Market

Olic means few. That means there are a few firms that dominate the market. Being more precise than that, there is a high concentration ratio.

Concentration Ratio of Oligopoly

In economics, a high concentration ratio means the market has not more than seven firms with collectively around 70% market share. That’s kind of how we define an oligopoly.

These firms will have differentiated goods, unique goods, which means that they are price makers.

There are high entry barriers and exit oligopoly markets, the major barriers to entry startup costs, economies of scale, sunk costs, brand loyalty. They tend to be quite strong.

In oligopolistic markets, there is interdependence. This is a defining feature, often oligopoly market, probably the most important characteristic.

What is interdependence? Interdependence means that firms don’t make decisions on their own independently.

No, they make their choices. They make decisions based on rival firms’ actions and reactions, so they don’t just make decisions independently. They think about what their rivals are going to do. They think about rival firms first and then make decisions.

Firms make decisions based on the actions and reactions of rival firms’ fundamental characteristics. We see price rigidity.

If there isn’t much competition on price, prices tend to be sticky or rigid. There is a lot of non-price competition. Therefore competition is based on branding, advertising, quality of product quality of service, etc.

Because of interdependence, profit maximization is not necessarily the sole objective of firms. Firms don’t make decisions independently. They always think about what their rivals are doing, what their rivals are going to do.

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

Firms are very close to having control over the market monopoly power in the market, and therefore anything that they could do that’s going to give them that power they’re going to do.

If that means profit maximization is the best, then by all means. But if it means a different objective is better, then they’ll pursue that.

Oligopoly Market Structure Examples

- We can take the global soft drink industry, absolutely a duopoly between Coca-Cola and Pepsi.

- The global car industry is a good example.

- OPEC is a legal oligopoly. A perfect example, the petroleum exporting countries, OPEC.

Kinked Demand Curve Oligopoly

What is the Kinked Demand Curve?

A kinked demand curve is a behavior that occurs when the demand curve is not a straight line but has a different elasticity for higher and lower prices. A kinked demand curve often occurs in an oligopolistic market structure where few firms offer similar or differentiated products.

Behavior due to independence is complicated, but one tool to help us is the kinked‟ demand curve model. Kinked‟ demand curve can nicely illustrate interdependence, leading us to our conclusion of price rigidity in two ways.

The first way to use kinked‟ demand curve is to understand that firms don’t want to change their price.

Kinked Demand Curve Elasticity

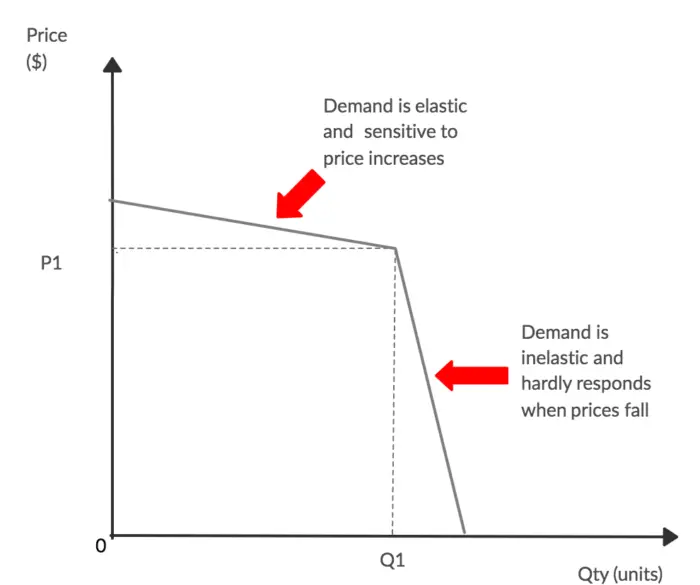

A kinked demand curve elasticity can be illustrated with an example. For example, the price in the market is currently a P1. It settled there, and the theory goes that around P1, there is different elasticity of demand.

Above P1, there is a price elastic demand curve, and below P1, there is a price inelastic demand curve, therefore different price elasticity of demand around the price in the market of P1. Therefore, it makes no sense for a firm to change its price.

Pricing in Oligopoly Market structure

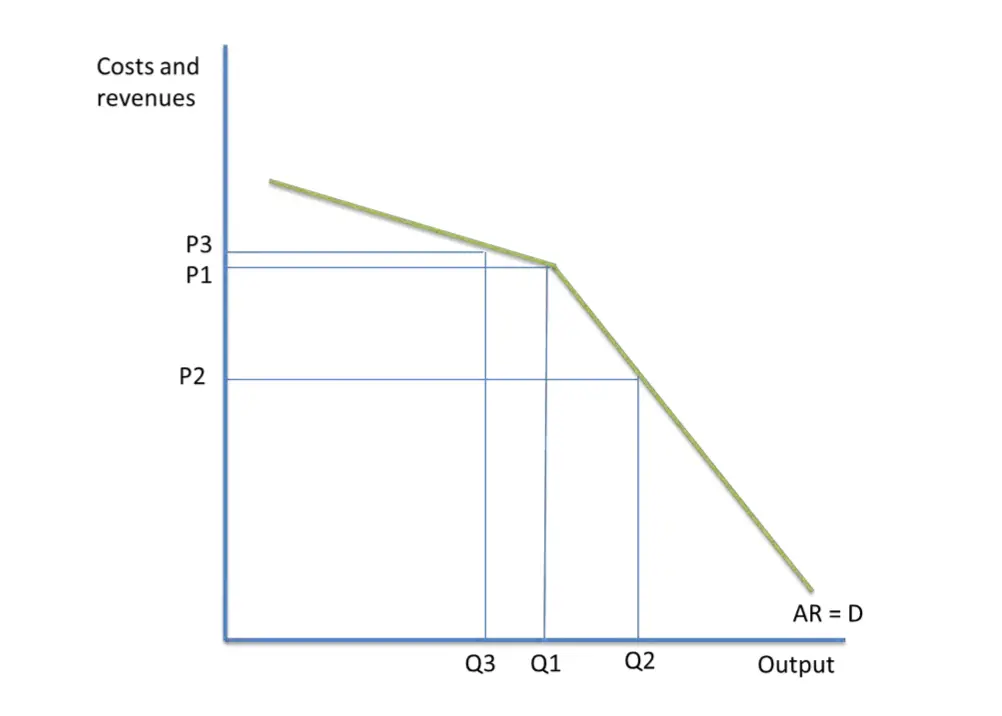

Let’s take an example and say a firm raises its price from P 1 to P3. The quantity demanded will decrease (Q3-Q1) but decrease proportionately more than the price increase.

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

Why is that? As a firm moves on to the price elastic part of the demand curve because of interdependence, other firms will not follow this price rise because they intend to gain market share, and therefore other firms will keep their price of P1 and undercut this firm.

The firm that raised their prices will suffer if all the other firms in the market will keep that price of P1. Demand is going to drop off significantly, and as a result, market share will decrease. Total revenue is going to decrease as well firm.

Therefore, raising the price above P3 makes absolutely no sense because of interdependence and how other firms react.

What about reducing the price in the oligopolistic market?

Let’s say this firm goes for a big decrease in price from P1 to P2, a huge decrease in price.

Because of the law of demand, demand will increase from Q1 one to Q2 but proportionately less than the price reduction. The firm now moves on to the price inelastic portion of the demand curve.

Why is the proportional increase in quantity demanded going to be less than the falling price?

It is because of other firms and how they’re going to react. Other firms are going to follow, looking to protect their market share.

They’re going to follow and get into a price war with the firm that reduced the price. As a result of that, total revenue is going to decrease.

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

Remember, if we reduce price and demand is price inelastic, total revenue will fall over time. There will be no change in market share; therefore, even a price reduction is not in the firm’s best interests as they move on to the price inelastic portion of the demand curve.

So, it’s clear from the very basic Kinked Demand curve model that firms don’t want to change their price.

Why Price Rigidity under Oligopoly Market

By raising the price, they’ll lose market share, and reducing the price won’t gain any market share in the long run. They’re going to lose revenue in both cases.

Changing price altering price from P1 makes no sense for the firm because of interdependence. Therefore, there is an argument of price rigidity in oligopoly.

Marginal Revenue and Kinked Demand Curve

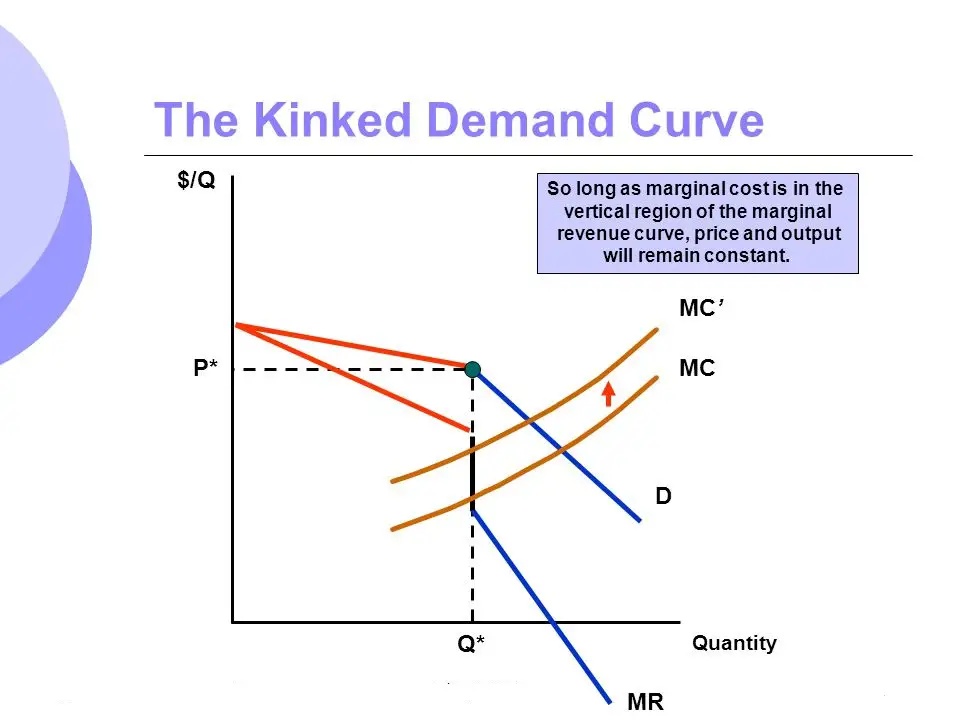

Another way to use the Kinked Demand Curve to understand why firms don’t need to change their prices is using the marginal revenue curve. The marginal revenue curve will look like the diagram below.

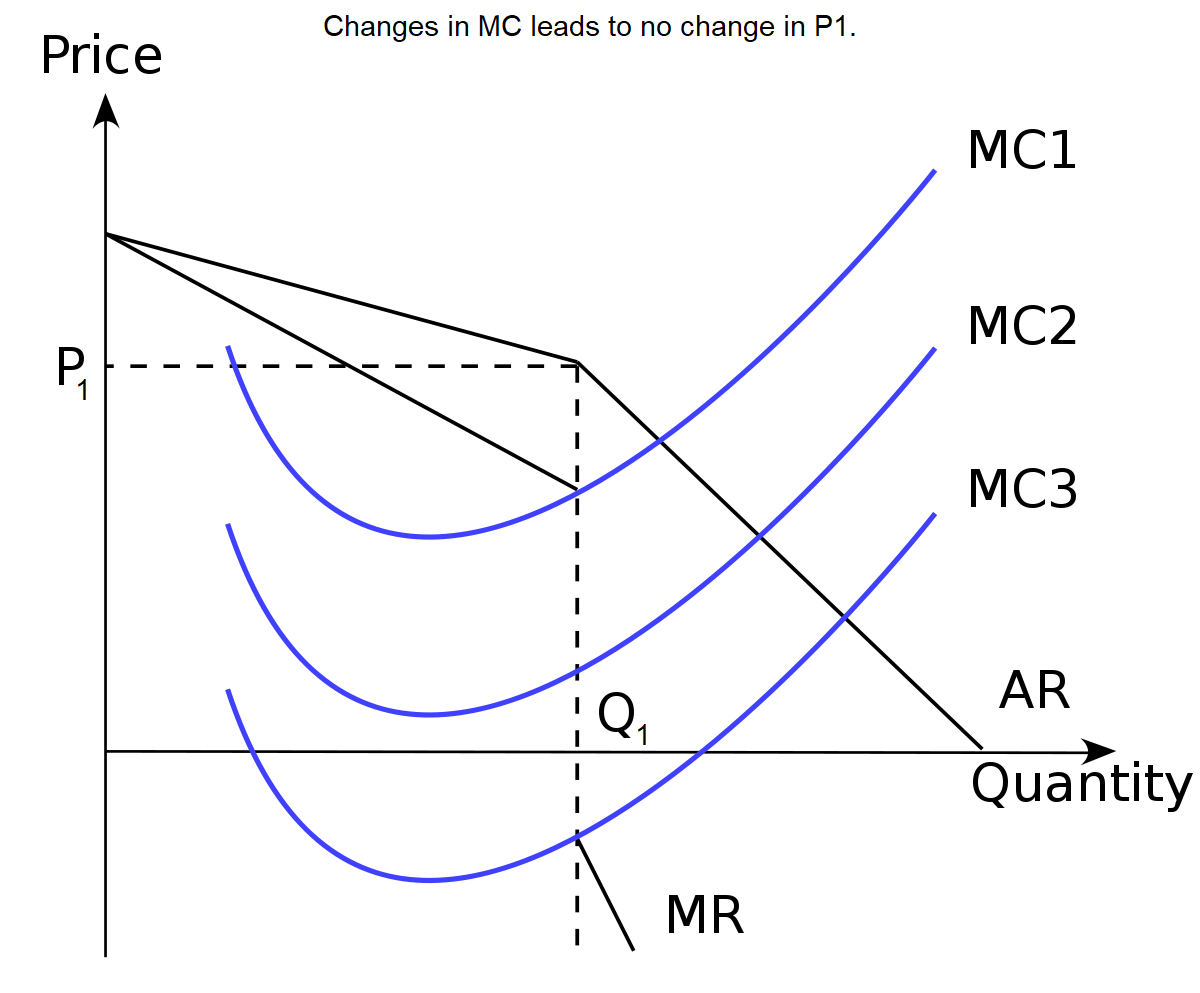

The idea is that if costs change within the gap, so let’s say cost increase, then marginal cost MC1 and cost to increased MC2.

The idea is, as long as costs change within this vertical gap, if the oligopolies are a profit maximize their production, Where MC equals MR, they are going to be charging a price of P1.

If the oligopolies are a profit maximizer producing where MC equals MR, in both cases, MC equals MR will give us a quantity of Q1.

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

Remembering that we read the price of the AR curve as long as quantities of Q1, the price is always going to be reading off the AR curve P1

So we can understand that because there is a vertical gap in the MR curve as long as costs change within this vertical gap.

A profit-maximizing oligopoly producing where MC equals MR will always charge a price of P1. Firms don’t need to change their price potentially if costs were to change within this vertical gap.

Kinked Demand curve model Conclusion

Even though there is price competition in an oligopoly market, raising the price or reducing the price doesn’t make sense, but firms may still try and reduce the price to gain market share, to out-compete rivals in a price war.

There is a lot of non-price competition if we agree that prices tend to stay sticky and rigid at P1. It makes sense with more nonprice competition like in the global soft drink industry, such as competition on branding, advertising, and quality.

Because Interdependence is frustrating because there is not much price competition, it means firms are always kind of looking at what their rivals are doing, how their rivals going to react.

As s result, there is a powerful temptation in an oligopoly to break into dependence and collude together, not have to worry about how rivals will react, worrying about what to do with your price.

If you’re colluding, you can act like a monopoly, fixed prices, and make a very high profit. The is that powerful temptation to ditch interdependence, collude on fixed prices, and make very high profits.

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.