Prebisch Singer Hypothesis Economics

The major issues with relying on the export of primary commodities to fuel trade growth and development are that in the long run, terms of trade will decline for countries that overspecialize in exporting natural resources in primary commodities.

That hypothesis is known as the Prebisch singer hypothesis. Put it simply, there will be a long-run decline in terms of trade for countries that depend on natural resource exports.

Prebisch Singer Hypothesis suggests that the price of primary goods such as coal, coffee, and cocoa decline in proportion to manufactured goods such as cars, washing machines, and computers over the long run.

Therefore, countries with a high export dependence on primary products, for example, low diversification in their commodity pattern of trade, may lose out from a worsening of the terms of trade.

They will have to import a greater quantity of exports to pay for essential imports such as raw materials, consumer goods, and capital goods.

Prebisch Singer Hypothesis Economics

This means that countries that export primary goods that do not have the means to manufacture goods to export will lose out in the long run as their goods will become relatively cheaper than the manufactured ones.

Prebisch Singer Hypothesis Income Elasticity of Demand (YED)

A common explanation for the phenomenon is that the income elasticity of demand for manufactured goods is greater than that for primary products, especially food. Therefore, as incomes rise, the demand for manufactured goods increases more rapidly than the demand for primary products.

The income elasticity of demand for exports and imports in developing countries and what drives that is the wealth effect.

The worry with this is that the leading exporters of primary goods are developing countries. This means that any hope of ever industrializing without borrowing large amounts, which is hard with a low credit rating, is slim as they will not be making much profit on their exports while being faced with a higher cost of imports.

What Prebisch singer hypothesis argue is that the exports, natural resource is primary qualities, these exports of developing countries are quite an income inelastic when income increases in the world.

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

There might be an increase in demand for these things, but not hugely; they are classes and necessity goods.

The problem is what imports are and how imports are linked to income elasticity of demand (YED) Prebisch singer argues that what developing countries import are very income elastic.

When people get richer, they demand more of what developing countries import, which capital imports, which are manufactured goods essentially.

The problem with that is in the last 20 -50 years, the world has got a lot of richer growth, and the global economy has increased massively. Average incomes of recent massively and all that’s done are driven demand for manufactured products.

And what that’s done is increased the price of manufactured products massively relative to the price of primary products, which you stayed relatively low and stable.

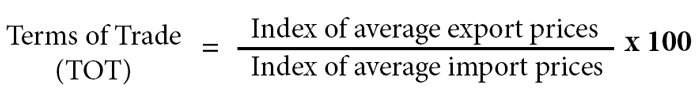

What is Terms of Trade?

Terms of trade is an index of export prices over the index of import prices multiplied by 100.

Terms of Trade Formula

If there is an improvement in trade terms, either on the index of export prices, increased relative to import prices, or import prices index has fallen relative to the index of export prices. That’s an improvement in terms of trade.

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

The opposite is true for a deterioration of the terms of trade,

Prebisch singer’s hypothesis said that countries that rely on the export of natural resources would suffer from a long-term decline in terms of trade.

In the long term, the terms of trade figures end up going lower and lower and lower.

Prebisch Singer Hypothesis On Developing Countries

Prebisch singer argues that in the long term, that pattern will continue because of income normal elastic goods like manufactured products and income inelastic goods, normal goods but necessity goods like primary products.

As a result, in the long term, import prices are likely to increase much faster than export prices are for these developing countries.

This means in the long term, they’re going to suffer from the fall in terms of worsening of the terms of trade. This, in simple terms, means that for a developing country to import the same amount of goods and services they’re importing before they need to export more to gain enough revenue to fund higher prices of imported goods.

That’s not good for the well-being and quality of life of people in developing countries. After export more, and they’re only getting the same back in return.

In the long term, they become worse off, and development suffers as a result. Based on the hypothesis, countries are advised to use revenues from primary commodity exports to fund education, develop skills, expand technological capacity, develop manufacturing capacity, and greater diversity of output will also be important.

Prebisch singer advises that there might be short-term swings, the terms of trade in the short term may improve like the last five years, there have been an increase in the price of natural resource is so promising to say this may happen in the short term. But developing countries need to act and realize that this is only a short-term phenomenon, a short-term equilibrium.

They need to get extra export revenues in terms of trade that may improve in the short term. Instead of just using those revenues to buy more imports to buy more capital imports, use those revenues to diversify the economy. Use those revenues to break away from undue dependence on primary products.

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

If you do that, you can prevent this massive issue of the long-term decline in trade. You could benefit from not only exporting primary products, but you can also export, diversify, exporting manufactured goods, semi-finished goods, or even finished goods instead of just primary.