Demerit Goods Examples

What are Demerit Goods

A demerit good is a service or product that people believe will have negative consequences for them. Demerit goods are a type of good that, despite their benefits, pose certain social problems. This can be due to the unhealthy nature of the goods, like fast food, or simply because it’s seen as socially undesirable and degrading, like cigarettes.

Goods that are considered to be of lower quality and which have a negative social stigma attached to them. For instance, cigarettes and alcohol may be considered demerit goods because they can lead to health issues.

Merit Goods

Richard Musgrave’s definition of merit goods applied in economics is a commodity that is judged to be required by a person or a society on the basis of a certain principle of need rather than skill and willingness to pay.

Example/List of Merit Goods

1. Clean water

2. Education

3. Vaccines and medicines

4. Food security

5. Basic energy services

Demerit Goods Examples/List of Demerit Goods

Demerit Goods Examples/List of demerit Goods include;

- Alcoholic beverages; Liquor, wine or beer

- Cigarettes or other tobacco products

- Any intoxicating substance (including marijuana)

- Pornographic material of any kind (including publications)

- Gambling devices and materials (including lottery tickets)

- Weapons of any kind, including firearms, ammunition, and knives

- Cigarettes or other tobacco products, drugs, and narcotics, including marijuana

- Lottery tickets

- Gambling devices (including slot machines), gambling paraphernalia, and/or any equipment associated with gambling

Characteristics of Demerit Goods

Demerit goods have these two characteristics:

- Harmful, unhealthy to the individual consumer.

- Demerit goos also usually have negative externalities.

Demerit Goods and Negative Externalities

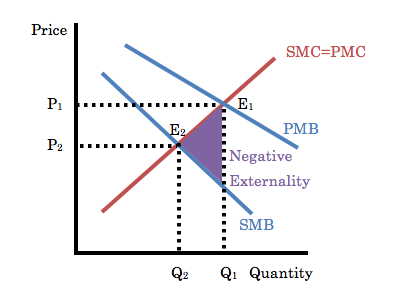

There is a major philosophical difference between demerit positive and negative externality. Negative externality arises when good consumption has observable negative effects for those who do not consume the good themselves.

Pollution attributable, for example, to the use of vehicles is a canonical example of a negative externality. On the other hand, a demerit good is seen as undesirable because its use negatively affects the customer, such as cigarettes.

Cigarettes have both properties – they are a positive demerit since they harm the wellbeing of the smoker. However, they also create the negative externality of the harm caused to others by second-hand smoke.

Two basic views on poverty, welfare, and paternalism vary in their philosophical treatment of ‘demerit products.’

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

Welfarism takes the individual’s perception of the usefulness of a good as the final judgment of that person’s usefulness. It thus disallows the idea of ‘demerit fine’ (while allowing the analysis of negative externalities).

As an extreme example, if a heroin addict buys heroin, they would have done so because heroin makes them better off. This transaction is seen as a good net social transaction (assuming that the addict does not commit any other crimes due to their addiction).

On the other hand, paternalism judges that heroin “is not good for you” and feels free to circumvent the decision of the users themselves.

Demerit Goods and Market Failure

The importance of this topic is that it can help you determine if the government should tax a product or service in order to prevent people from consuming too much and thus causing negative externalities. This information is imperative for any individual who wants to understand why governments tax certain products and how they do it.

A demerit good has a negative externality, and it can be thought of as a negative consumption experience. Demerit goods are often marked by excessive use and abuse; examples include tobacco, alcohol, drugs, guns, and payday loans. Consumers who purchase these goods do not bear the full costs associated with their usage (i.e., they create externalities). Those purchasing demerit goods will often over-consume them because they are unable to account for all of their expenses incurred from continual use or misuse of these products.

The government can impose taxes on producers or consumers in order to intervene in the market for de-merit goods. But many economists argue that taxation is an inefficient and inequitable way to curb drug use and gambling, particularly for those affected by addiction.

Banning or restricting consumption by legislation may reduce demand, but there may be risks creating secondary (illegal) or underground markets for the commodity.

The free market may not take into account the negative externalities of consumption because the social cost is higher than the private cost. Consumers, too, can encounter incomplete information on the long-term costs of buying items considered to be de-merit goods themselves.

The welfare loss associated with ‘over-consumption’ of a demerit good is the excess of Social Marginal Cost above Social Marginal Benefit, which is the quantity Q2 to Q 1 in the above diagram the welfare shaded area.