Automatic Stabilizers Economics

Automatic stabilizers are government programs that require no legislation and helps soften the economic impact without any discussion or debate among elected officials.

Automatic Stabilizers are built-in stabilizers to ensure that an economy experiences less severe recessions and less severe inflation.

The stabilizers are automatically regulated by tax revenues and government spending and transfers and will l automatically adjust when the economy experiences a contraction or expansion and output way.

Automatic stabilizers or something the government can fall back on to negate the fluctuations in economic growth to equalize the size of the business side fluctuations.

The beauty of automatic stabilizes is that it’s a part of fiscal policy that’s automatic that doesn’t need to be actively changed by the government.

How do Automatic Stabilizers Work?

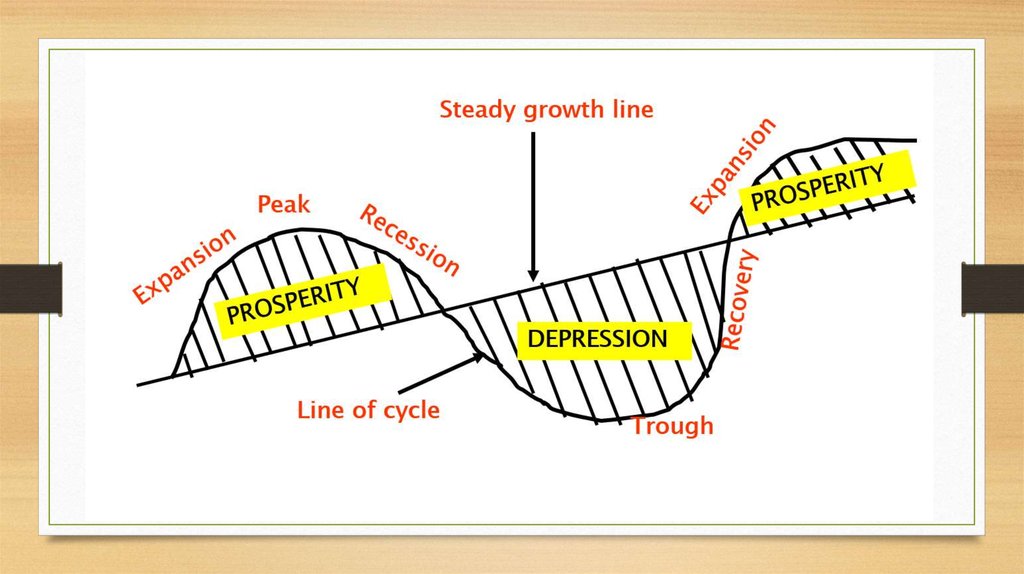

Economic Cycle

The economic cycle is the economy’s fluctuation between periods of contraction (recession) and expansion (growth). The economic cycle is determined by interest rates, gross domestic product (GDP), employment rate, and consumer spending.

The economic cycle is a trend of upward and downward GDP movements that ultimately determines an economy’s overall long-term growth. There are peaks and troughs, booms, and recessions in the economic cycle.

Automatic Stabilizers During Recession

During the recession, tax revenues will automatically decrease when people start losing their jobs, and people’s incomes start to fall, resulting in a decrease in tax revenues.

Many businesses are not going to be making profits during this period. The overall confidence in terms of investment and general business profits will fall. Therefore the level of corporation tax collected by the government is also going to fall.

Again, people lose their jobs and become unemployed and slip into unemployment, and there will be an increase in government spending transfer payments. The government will automatically start providing more benefits to people who lose their jobs. Certain people who fall into the poverty line will start collecting welfare payments and other government subsidies to help them get by while in economic hardship.

There is a lot of unemployment in the labor market during the recession, and government spending will automatically rise. The government spending specifically on benefits will rise because more and more people are unemployed. The government needs to spend more benefits automatically.

The tax revenues automatically go up, and government spending automatically goes down, helping soften the positive demand’s impact and prevent the economy from overheating.

When output falls, unemployment falls, and government spending automatically goes up. When people lose their jobs, and people slip into poverty and start collecting government benefits.

Shock inflation will be lower than it would be without these automatic stabilizers; built-in fiscal policy is an excellent tool for policymakers to use.

Similarly, the government’s tax revenue will fall in the recession because of fewer people at work hence less tax being paid.

To some extent, these factors will allow aggregate demand to increase without the government actively getting involved. It all there are some benefits to automatic stabilizers.

Government spending on transfers and low tax revenues means there is a decrease in real GDP. Actual GDP falling means national income is falling, and fewer taxes are being collected.

Tax revenues will fall simultaneously, the government spending on transfers rises, and we have a situation in which the government has a budget deficit.

The government will automatically slip into a budget deficit because government spending on transfers will be higher than tax revenues.

Automatic Stabilizers During Expansion

During the expansion period, GDP will increase again, and the economy is booming. Here tax revenues automatically increase. The tax revenue collected increases because more people work, they pay more income tax. Companies will have better profits. They get higher revenues, which means they’re going to pay more corporation tax.

Firms are earning more revenues, Households are earning higher incomes, unemployment is lower, more people have jobs, and more people are earning wages.

Therefore, more people are paying more taxes; the government automatically starts to collect more taxes.

At the same time, fewer people are unemployed, fewer people are in poverty, and there’s less need for government to spend as much as they were on things like food stamps or subsidies for low-income housing or unemployment benefits or Medicaid or any of the other services that people who are struggling in the economy would receive from the government.

There are many people at work in the labor market, and in that sense, government spending on benefits decreases.

These two things are therefore going to reduce aggregate demand and automatically stabilize the economy. It will prevent the economy from growing very quickly in a boom period.

The point of automatic stabilizers is they reduce the overall fluctuations in the business cycle. They allow the economy to transition on a smooth path of growth rather than suffering these significant fluctuations in actual growth.

The size of the deviations from the trend rate of growth minimizes. The actual growth does not deviate from trend growth because the automatic stabilizes reduced the recession’s depth, firing an automatic increase in demand.

Because of these factors and in a boom time, the level of growth automatically stabilizes. It decreases because of the automatic reduction in aggregate demand, slightly because of these policies’ contractionary effects but the automatic stabilization’s negative effects.

Bear that in mind, automatic stabilizes, stabilizes the economy automatically without any need for active fiscal policy.

But the active fiscal policy may still be necessary to reduce the overall effects of the recession and reduce the rampant inflation and rampant growth caused by a boom period.

In macroeconomics, automatic stabilizers are features of the structure of modern government budgets, particularly income taxes and welfare spending, that act to dampen fluctuations in real GDP

Discretionary Fiscal Policy

Discretionary fiscal policy is when governments get together and look at the country’s economic situation at a particular period of time and decide to enact changes to the level of government spending and taxation.

These changes usually require the government to agree and pass legislation to cut taxes or increase government spending or raise taxes and decrease government spending.

However, this deliberation and debate process could go on for months, sometimes even longer than that, before the government decides what it needs to do in terms of government spending and taxation to help achieve full employment’s macroeconomic objectives.

Expansionary fiscal policy

Expansionary fiscal policy occurs when government spending increases or taxes decrease. That happens automatically when a country experiences a recession and doesn’t require the government to enact some laws.

It’s going to happen anyway, so this is an automatic adjustment that occurs following a demand deficient recession. The impact this could have on the economy is to soften the negative demand shock, so we’re probably not going to see a recession wholly avoided.

However, due to automatic stabilizers, we could end up in a situation in which the decrease in aggregate demand will be less severe than it would have been if there were not these social safety nets built into the economy.

The fact that taxes automatically go down when people start to lose their jobs, people’s incomes fall, and government spending automatically starts to rise is people slip into unemployment or slip into poverty. The government will help soften the blow without any discussion or debate among elected officials.

Government policymakers tend to be very slow and non-responsive when it comes to economic shocks. Therefore, the time legs built into fiscal policy could be avoided in the form of automatic budgetary policy.

The economy will automatically soften its blow through the changes of government spending and taxation to take place following a recession.

Example of Automatic Stabilizers ( Govt. Spending)

Recently US Government passed a Stimulus Package, Coronavirus Aid, Relief, and Economic Security Act (2020), which provided over $2 trillion in government relief to small businesses through federally guaranteed loans to employers to maintain their payroll. The assistance shall be to covered costs such as payroll, paid sick leave, supply chain disruptions, and employee salaries

Summary

These are government spending and taxation changes that happen automatically without elected officials having to debate for months on end about what to do.

Automatic fiscal policy is built into a nation’s government budget: government spending and taxation change automatically, and the country’s fundamental GDP changes in the short run.