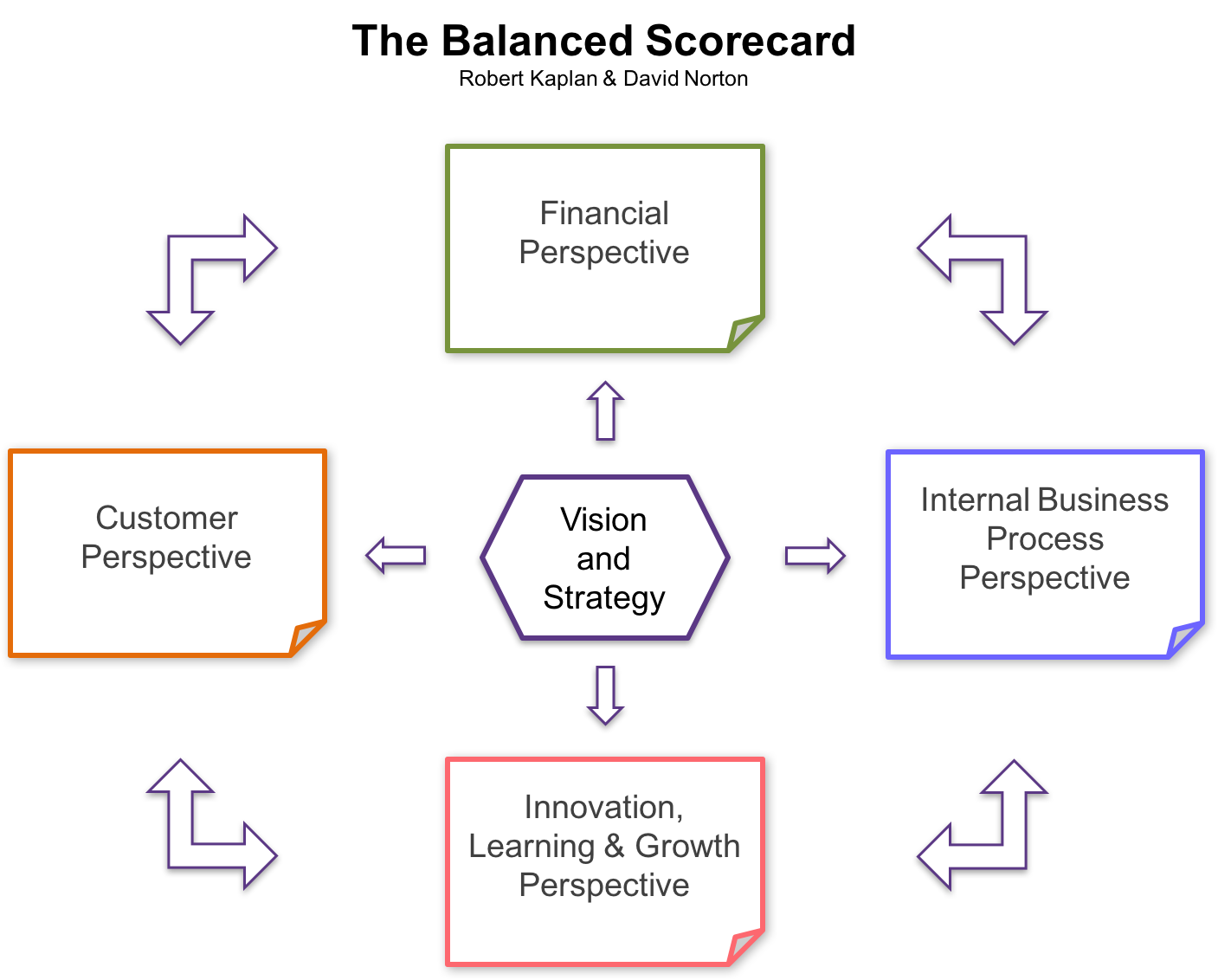

Kaplan and Norton Balanced Scorecard 1992

Kaplan and Norton Balanced Scorecard.

Kaplan and Norton developed this theory in the early 1990s (1992) when people were really starting to take a look at businesses: their behavior, ethics, strategies, their visions, and starting to question some of the morality in the ethics of different business organizations.

Throughout history, many, many businesses have a long social context to them. Like Cadbury’s, a very famous business that we still have today was founded by a Quakers family, a religious movement, who felt a very tight responsibility to their workforce.

They didn’t just employ them. They didn’t just pay them. They built them homes and leisure facilities and villages surrounding the factory where they employed them on felt a very close kinship on responsibility towards their workforce.

Fast forward to the 1980s, and there were shifts in the UK and America’s economy. There were changes whereby the government was employing fewer people, and more people worked in the private sector.

There more and more people becoming entrepreneurs, and there was a real drive to stimulate business startups.

Alongside that, more and more people were starting their shares in organizations and seeing that as part of their financial wealth on these were things that perhaps not many people did in the past in the 19 eighties was really a time of evolution and change in business.

And part of that, there was a shift in what business is focused on. They became very centered on chasing profits, and making short-term decisions to boost profits and generate shareholder returns became something of a priority for many organizations.

By the time 1990s, some theorists have started to question that approach.

The key focus was the moral way of running an organization with key financial measurements and general performance.

It is then that Kaplan and Norton developed a theory whereby they were encouraging businesses not just to appraise themselves and measure success against financial measurements but to take a broader, more holistic view of the health of the organization and consider success in terms of four different measurements rather than just one.

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

They included:

- Financial

- Internal Processes

- Innovation and Learning

- Customers

Kaplan & Norton – The Balanced Scorecard

The concept is illustrated in the table below.

| Perspectives | Questions | Goals | Measurements |

| Customer | How do customers see us? | ||

| Internal business | What must we excel at? | ||

| Innovation & learning | Can we continue to improve and create value? | ||

| Financial | How do we look to shareholders? |

Finances.

Kaplan and Norton didn’t turn away from financial measurements, and they didn’t say that they weren’t important; they said that they were absolutely critical.

Businesses needed to set themselves targets and objectives and measure how they perform in terms of sales revenue, profitability, and shareholders’ value and dividends.

These are absolutely front and center businesses that have the responsibility, their shareholders.

Kaplan and Norton said that businesses still need to remain tightly focused on how their shareholders perceived the organization.

They noted that if you’re going to experience success in the long term, a positive perception from shareholders is absolutely critical.

Internal Processes of The Organization,

It is looking at some of the internal mechanisms of where or the workings of the organization.

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

Kaplan and Norton suggested that, just like profits, business is needed to be setting and measuring targets to do with these elements on devising strategies that they track and review to generate long-term rewards on success.

The kind of internal processes that they’re referring to were things like the organization’s productive efficiency—tracking things like labor productivity, capital productivity, efficiency measures like their labor costs, their unit costs, and looking at other organization measures.

Again, they noted that rather than just making decisions and designing strategies that focus on short-term profits, they should factor in designing objectives and strategies to do with improving and monitoring the business’s internal processes.

Kaplan and Norton said, look, businesses have become a little bit short-sighted, a little bit myopic, and they should be trying to focus on longer-term goals, not just finances, but also judging and appraising their success terms of other areas as well, such as internal processes.

Innovation and Learning

This really is an investment in the organization. Investment in research and development means investing retained profits into research and development for tomorrow’s products. Kaplan and Norton said, to have a long-term sustainable organization, you’ve got a judge success against these measurements, not just these.

It could include developing new products, things to do with your employees’ training and investing in their skills and staff development on even things like investing in things like employee participation schemes.

Kaplan and Norton were encouraging businesses to move away from purely judging success on finances and looking at some of these growth unlearning goals to judge success on the health of the organization.

Customers

Kaplan’s final aspect and often brought to the table, was to do with customers and how customers might perceive the organization.

For some organizations at the time, they might not have been too concerned about how they were perceived by customers as long as they were making profits.

But there’s only so long that you can sustain unsatisfied customers before going to take a longer-term hit on your success and your profits.

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

Kaplan and Norton encourage businesses to set targets and develop strategies surrounding appeasing the needs of customers.

The kind of targets that can be set in order to try and measure that could be things like the number of repeat customers and could link it to tracking and measuring market share.

We might assume that if our market share is developing and growing, customers have positive perceptions about the organization.

Survey results on customer satisfaction could be done as well.

These are the kind of things that are really going to make organizations have customers that they’re going to spread positive word of mouth, have positive customer experiences, and are going to become repeat and loyal brand customers.

We might try and look at what to set ourselves targets to do with the number of returns that we have from customers driving that number down. Even if we have to invest money into improving processes and improving quality though it might damage finances in the short run, Kaplan and Norton were encouraging managers at the time to think about long-term organization.

Kaplan and Norton Balanced Scorecard Example

For example, Kaplan and Norton’s Balanced scorecard is provided for a company they refer to as Electronic Circuits Incorporated (ECI). The illustration below is based on the ECI scorecard that appears.

Electronic Circuits Incorporated’s Balanced Scorecard |

|||

| Perspectives | Questions | Goals | Measurements |

| Customer | How do customers see us? | New products. | Percent of sales from new products. |

| Responsive supply. | On-time delivery as defined by the customer. | ||

| Preferred supplier. | Share of key account purchases. | ||

| Customer partnership. | The number of cooperative engineering efforts. | ||

| Internal business | What must we excel at? | Technology capability. | Manufacturing geometry versus the competition. |

| Manufacturing excellence. | Cycle time, Unit cost, and Yield. | ||

| Design productivity. | Silicon efficiency and Engineering efficiency. | ||

| New product introduction. | Actual introduction schedule versus planned introduction. | ||

| Innovation and learning | Can we continue to improve and create value? | Technology leadership. | Time to develop the next generation. |

| Manufacturing learning. | Process time to maturity. | ||

| Product focus. | Percent of products that equal 80% of sales. | ||

| Time to market. | New product introduction versus the competition. | ||

| Financial | How do we look to shareholders? | Survive. | Cash flow. |

| Succeed. | Quarterly sales growth and operating income by division. | ||

| Prosper. | Increased market share and Return on Equity. | ||

Kaplan and Norton sum up by saying that “The balanced scorecard keeps companies looking – and moving – forward instead of backward” (p. 79).