Pigouvian Tax Example & Diagram | Pigouvian Subsidy

What is Pigouvian tax?

Pigouvian taxes are a type of tax that seeks to correct market failure. The idea is that when there is an externality, the market price does not reflect the true social costs of engaging in certain behavior. A Pigovian tax will then be collected from those who caused the negative externalities and redistributed back into society in order to repair some of these damages.

Pigouvian taxes are designed to reduce or correct an undesirable market outcome by offsetting it with taxation revenue. It uses economic theory to justify government intervention and harnesses the power of free markets. The main benefit is that it encourages people and businesses to behave in ways that achieve a socially desirable outcome (such as reducing pollution). The name “Pigouvian” comes from Arthur Cecil Pigou, who was one of the early economists to use this concept.

Pigouvian Tax is a tax on any business operation that produces negative externalities. The tax aims to correct an undesirable or unsustainable market result by setting the external marginal cost of negative externalities at the same amount. Economic costs include private costs and external costs.

Pigouvian Tax Diagram

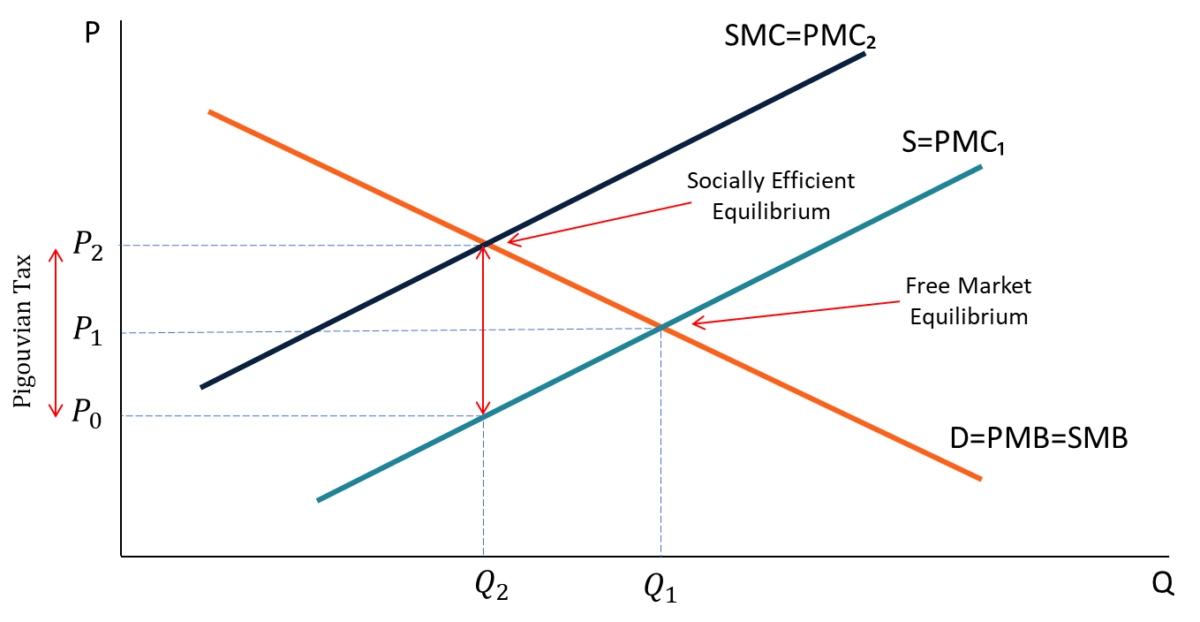

Example: Consider the Pigouvian tax diagram below: The horizontal axis or x-axis measures the polluting factory’s amount of output. The vertical axis or the y-axis measures monetary units.

The Social marginal cost (SMC) represents the total marginal cost for the whole society. It is constructed by adding together the private costs (which directly translate to higher prices) and social costs.

In a free market, the equilibrium will be at Q1 – where Demand =Supply. At this output, there is social inefficiency.

Again, at Q1, the social marginal cost (SMC) is greater than the social marginal benefit (SMB), which means there is overconsumption.

If the government places a tax equal to the external marginal cost, consumers will pay the full social marginal cost. (SMC) This will reduce the demand from Q1 to Q2, and this will be socially efficient because at Q2 (SMC=SMB).

Pigouvian Tax Formula/How to Calculate Pigouvian tax

The requirement for efficiency is that the social marginal cost of production should be equal to the social marginal benefit, which again is equal to the private marginal benefit:

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

SMC = SMB = PMB

Suppose further that this market operates according to the principles of perfect competition except that the market prices with which producers and consumers are faced are allowed to differ.

Producers, who are assumed to maximize profits, set their private marginal cost equal to the producer price (p), while consumers, who maximize utility, equate their marginal benefit to the consumer price (P):

PMC = p, PMB = P.

Now, if the tax rate is defined by the equation P = p + t, we can substitute in the first equation to obtain the socially optimal deviation between the consumer and producer prices,

SMC – PMC = P – p,

or the socially optimal tax rate

t = SMC – PMC

A tax rate that is equal to the difference between social and private marginal costs perfectly internalizes the externality and restores efficiency to a market that would otherwise have found itself at an inefficient equilibrium.

Pigouvian Tax Example Problem

A common example of a Pigovian tax type is the pollution tax. Pollution, for example, is an externality. Drivers of non-compliant cars do not immediately suffer from exhaustion, but everyone behind them does. Their exhaustion also raises emissions for all in the city. This risk cost might manifest through health risks caused by pollution.

The government imposes taxes on non-compliant vehicles in Pigouvia to impose higher prices on drivers to compensate for their misery. Tax revenue is also used to improve external expenses.

What does a Pigouvian tax do?

A Pigouvian tax is a type of tax intended to correct some kind of market failure. The name comes from the economist Arthur C. Pigou (1877-1959), who suggested that such taxes could be used as a tool to internalize externalities in his book “The Economics of Welfare” (1920).

Pigouvian tax is a type of tax that is placed on goods and services like that cause pollution. A Pigouvian tax (or, more specifically, an emission fee) aims to reduce the amount of pollution by making it more expensive for people to pollute.

The reason why it’s a good idea to have the government set up such taxes lies in its ability to create incentives for companies and individuals not to pollute excessively. This way, they can save money if they do not pollute as much as possible while having revenue generated by those who do pollute too much,

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

Pigouvian Subsidy

The Pigouvian subsidy is a mechanism that government can use to make sure some people do not free ride on their taxes.

For example, if the government subsidizes electricity consumption by low-income families in order to get them off kerosene and improve their health, this policy is called Pigouvian Subsidy.

Do Pigouvian taxes have a Deadweight loss?

Pigouvian taxes are considered to be the most efficient approach for dealing with externalities and correcting market failures. However, there has been a recent debate about whether Pigouvian taxes can cause deadweight loss.

For example, pollution from a factory produces a detrimental externality as part of the cost of pollution is borne by affected third parties. This cost can manifest as a result of polluted property or health risks.

The polluter only takes into account private costs, not external costs. When Pigou compensated for external costs to society, the economy experienced a deadweight loss of excess emissions above the “socially optimal” stage.

Pigou believed that the State intervention had to correct negative externalities, which he considered to be a business failure. He proposed that this be achieved by taxation.

Pigouvian tax advantages and disadvantages

Pigouvian tax advantages

- One advantage of Pigouvian taxes is that they encourage business productivity by adding the added costs of negative externalities.

- Pigouvian taxes help the State impose intervention for correcting negative externalities, which he considered a business failure.

Pigouvian tax disadvantages

- The presumption that the government will calculate the marginal social cost of a negative externality and turn that amount into a monetary value is a flaw of the Pigovian tax system.

- Economies have also pointed out that political factors can complicate the implementation of a Pigovian tax.

- Pigouvian tax is complicated to calculate. Without knowing in advance the most efficient outcome, the government cannot issue the right Pigovian fee. This will include the awareness of the exact sum of external costs levied by the manufacturer and the correct price and production for the particular sector.