Recessionary Gap and Inflationary Gap

Recessionary Gap

What is a Recessionary Gap?

A recessionary gap is a macro-economic term that measures the disparity between the current level of real gross domestic product (GDP) and GDP that would occur if the economy operating at full employment. The gap between the level of real GDP and potential output, when real GDP is lower than potential, is called a recessionary gap.

The recessionary gap is also known as the contractionary gap. A contractionary gap is when the economy is operating below potential rather than at it, but not in a depression-like situation. An inflationary gap is when the economy is operating above potential rather than at it.

A recessionary gap is a measure of how much the economy has contracted compared to its potential level. The difference between the current GDP and what it would be if it were at full capacity.

Recessionary Gap is a term that was first used in 1991 by Lester Thurow, an economist and author who currently teaches at MIT.

How To Calculate Recessionary Gap

A recessionary gap is a difference between the GDP and potential GDP. It is calculated by subtracting actual GDP from potential GDP.

The recessionary gap can be used to determine how long it will take for a country to recover from a recession.

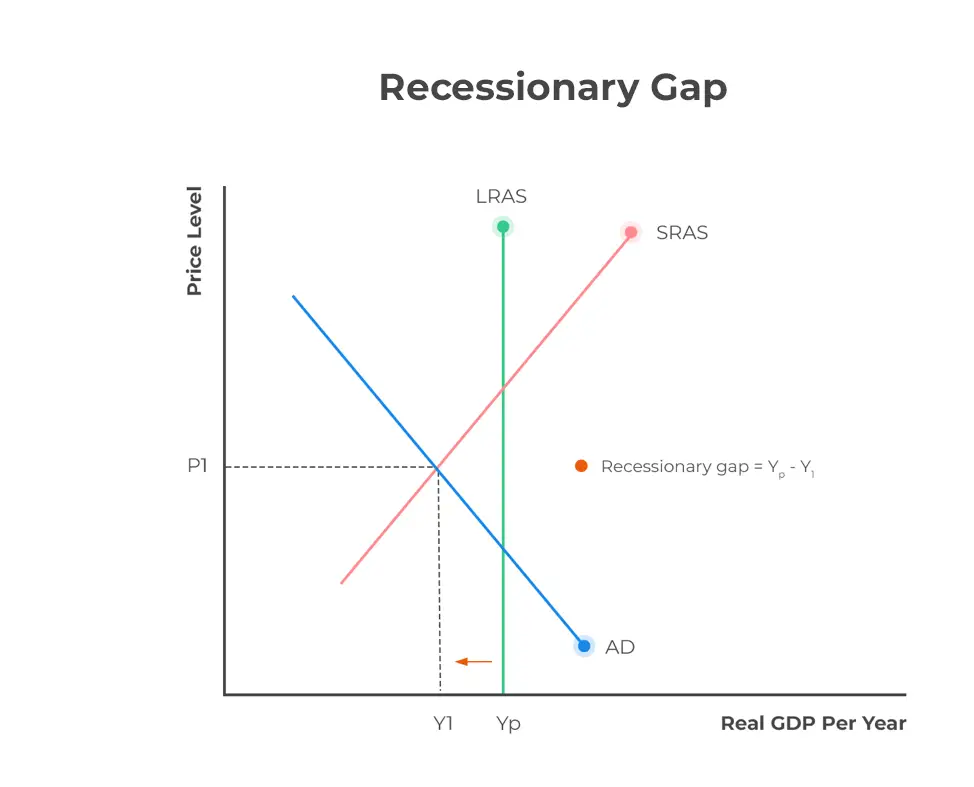

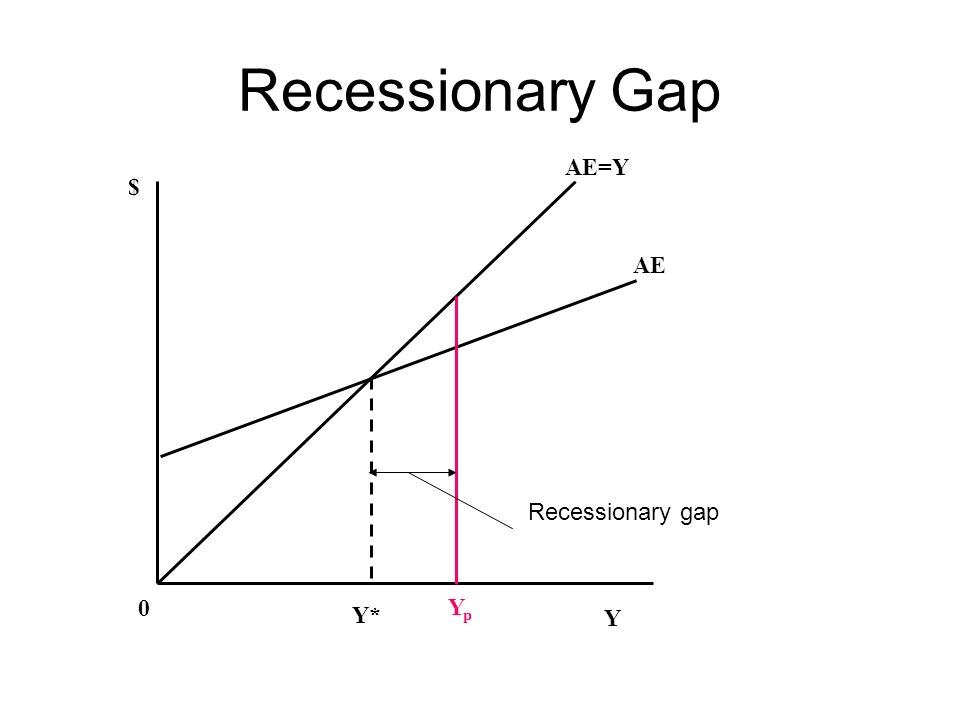

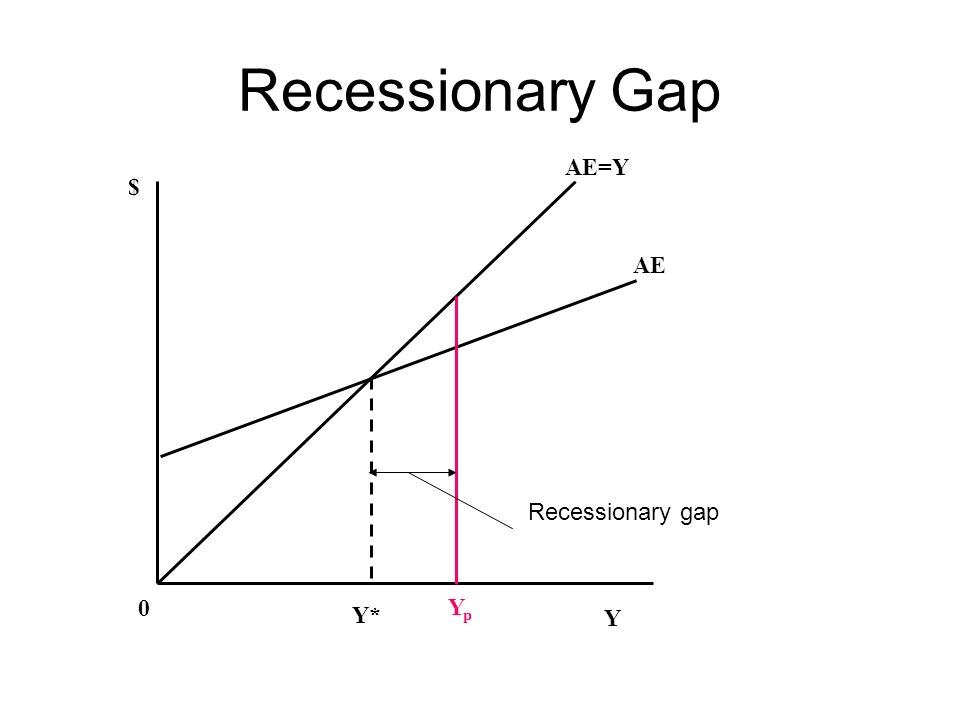

Recessionary Gap Graph Formula

The output difference calculation is Y*–Yp, where Y* is the real output, and Yp is the potential output.

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

If the calculation yields a negative number, it is called a recessionary gap—possibly indicating deflation.

The percentage of GDP difference is the real GDP minus the possible GDP divided by the potential GDP.

If real GDP < Potential real GDP (full employment GDP), then a recessionary gap exists.

Recessionary Gap Example

In this particular case, full employment results in $15 trillion of aggregate output, which is greater than the $12 trillion equilibrium of aggregate output.

The relationship between equilibrium and full-employment gross output suggests that the economy has a recessionary gap. The resulting recessionary deficit is $3 trillion in overall production. In other words, the gross output needs to increase by $3 trillion to close this gap.

This is called a recessionary gap because it occurs during a contraction of the economic cycle or a recession in which unemployment is the most important issue facing macroeconomic stability.

What Causes A Recessionary Gap?

Anything that tries to push the aggregate expenditure line down is a possible cause of the recession, including;

- A decrease in demand, an increase in savings, a fall in government spending or a rise in taxes,

- or a fall in exports or an increase in imports.

- It can happen for several reasons, including high unemployment rates, low consumer confidence, and declining business investment. These factors lead to less spending in the economy, which leads to lower demand for goods and services.

- It can be caused by an increase in imports, which leads to a decrease in exports.

- It can be caused by an economic contraction or by a drop in aggregate demand.

- It can also occur during times of high inflation or high-interest rates. This measurement helps economists determine whether there will be inflation or deflation.

- Inflation is also a major cause of the recession. Adverse changes in the price level, such as high inflation or deflation, reduce the purchasing power of money. A recession occurs when the level of overall demand for products and services falls. This often happens when there is too much supply of goods and services relative to the demand. The recessionary gap measures the difference between what the economy produces and what it needs to produce.

How To Fix/Close A Recessionary Gap

The recessionary gap is a measure of the difference between what an economy produces and what it consumes. This gap can be closed by either increasing production or reducing consumption.

Increasing production requires more investment, which could come from public sector spending on infrastructure projects or private sector investments in new technologies and equipment.

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

Reducing consumption would involve cutting back on imports, such as oil imports, to reduce the trade deficit.

Potential Gross Domestic Product (GDP) (Yp)

What is Potential Gross Domestic Product (GDP)?

Potential Gross Domestic Product (GDP) is a theoretical term in which resources are optimally distributed without distortion. For example, every worker is matched to the right job for his skill level; every good idea is enforced, etc.

Potential GDP is difficult to calculate with precision. Virtually, the economy rarely runs at potential GDP due to shifts in the aggregate demand curve and the short-term aggregate supply curve.

Economists, however, assume that the long-term growth rate of potential GDP can be approximated by constructing real GDP trend measures that smooth out fluctuations in market cycles.

How to Find/Calculate Real Gross Domestic Product

The following formula defines gross Domestic Product (GDP):

GDP (Y*) = C + I + G + NX (GDP = Consumption + Investment + Government Spending + Net Exports)

Where consumption

- C-represents private-consumption expenditures by households and nonprofit organizations, investment.

- I – refers to business expenditures by businesses and home purchases by households, government spending.

- G-denotes expenditures on goods and services by the government and net exports.

- NX- represents a nation’s exports minus its imports.

Inflationary Gap

What is an Inflationary Gap?

The Inflationary Gap is an economic term that describes the difference between a country’s potential GDP and its actual GDP. The gap between the level of real GDP and potential output, when real GDP is greater than potential, is called an inflationary gap.

Therefore, the inflationary gap refers to the difference between a country’s potential GDP and its actual GDP but gives a positive figure. An increase in aggregate demand can lead to higher prices than anticipated, which leads to inflation. This results in lower real production of goods and services because companies are uncertain about what things should cost, so they keep their prices low as well until there is more certainty.

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

The inflationary gap can also be explained as the difference between the economy’s capacity to produce goods and services and its production. If this gap continues to grow, people will start paying higher prices for many products, leading to a recession.

The Inflationary Gap refers to the difference between the economy’s ability to produce goods or services versus what it currently produces. This results in an oversupply of available products on the market, leading to inflation because people are forced into paying more for these items due to limited supply.

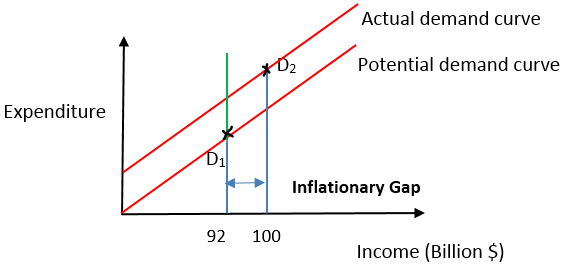

Inflationary Gap Graph Example (Inflationary Gap Diagram)

Excess demand or inflationary gap is the excess of aggregate demand over and above its level required to maintain full employment equilibrium in the economy.

If the inflationary expectation goes up, then so does the market interest rate and vice versa.

The GDP gap or the output gap is (Y* – YP). The output difference calculation is Y*–Yp, where Y* is the real output, and Yp is the potential output. (Check Inflationary gap diagram below)

Actual Demand = D2 = 100

Potential Demand = D1 = 92

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

D2-D1= 100-92 = 8. (Calculation yields a positive number); hence 8 is an inflationary gap.

Note: If real GDP > Potential real GDP (full employment GDP), then an inflationary gap exist

If this calculation yields a positive number, it is called an “inflationary gap” and indicates the growth of aggregate demand is outpacing the growth of aggregate supply (or high level of employment), possibly creating inflation, signaling an increase in interest rates made by the Central Bank;

That is, the rule “recommends” a relatively high-interest rate (a “tight” monetary policy) when inflation is above its target or when output is above its full-employment level in order to reduce inflationary pressure.

Recessionary Gap Vs. Inflationary Gap

The Recessionary Gap is the difference between potential and actual gross domestic product (GDP) and positive value. Y*>Yp

The Recessionary Gap is the difference between potential and actual gross domestic product (GDP) but gives negative value. Y*<Yp

Note: Potential GDP includes all of the goods and services that could be produced if resources were fully employed, while Actual GDP measures what has actually been produced in a given time period

Potential inflation reflects a situation where prices are stable, but there are shortages of goods or services because they cannot keep up with demand; Actual inflation measures what has happened to prices over a given time period.

An inflationary gap exists when the demand for goods and services exceeds production due to higher overall employment levels, increased trade activities, or elevated government expenditure.

A recessionary gap is a period of time in which an economy has contracted, but the rate of contraction slows. This can happen when there are signs that the economy is slowing down, such as a decrease in aggregate demand. It can also occur during times of high inflation or high-interest rates. If left unchecked, this could lead to deflation and increased unemployment.

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

Difference Between Inflationary Gap And Deflationary Gap

Inflationary Gap: -The inflationary gap is a measure of the difference between what an economy produces and what it consumes (its production potential).

Deflationary Gap: -A deflationary gap occurs when there are not enough goods or services on the market to fulfill demand.

How To Close Inflationary Gap

For the gap to be considered inflationary, the actual real GDP must be higher than the potential GDP. Policies that may minimize the inflation gap include cuts in government spending, tax rises, bond and securities problems, interest rate increases, and decreases in transfer payments.

Inflationary Expenditure Gap

The inflationary Expenditure Gap (IEG) is the difference between actual and potential GDP. Actual GDP is the total amount of goods and services produced in an economy, while potential GDP represents what could be produced if all resources were fully employed. When the actual GDP is more, the potential GDP is called the inflationary Expenditure Gap.

Inflationary Expenditure Gap (IEG) occurs when there are not enough jobs to employ everyone who wants one, which means that some people will have to work more hours or take a lower-paying job than they would like.