Bowmans Strategy Clock Model | Strategic Positioning Analysis

What is Bowmans Strategy Clock?

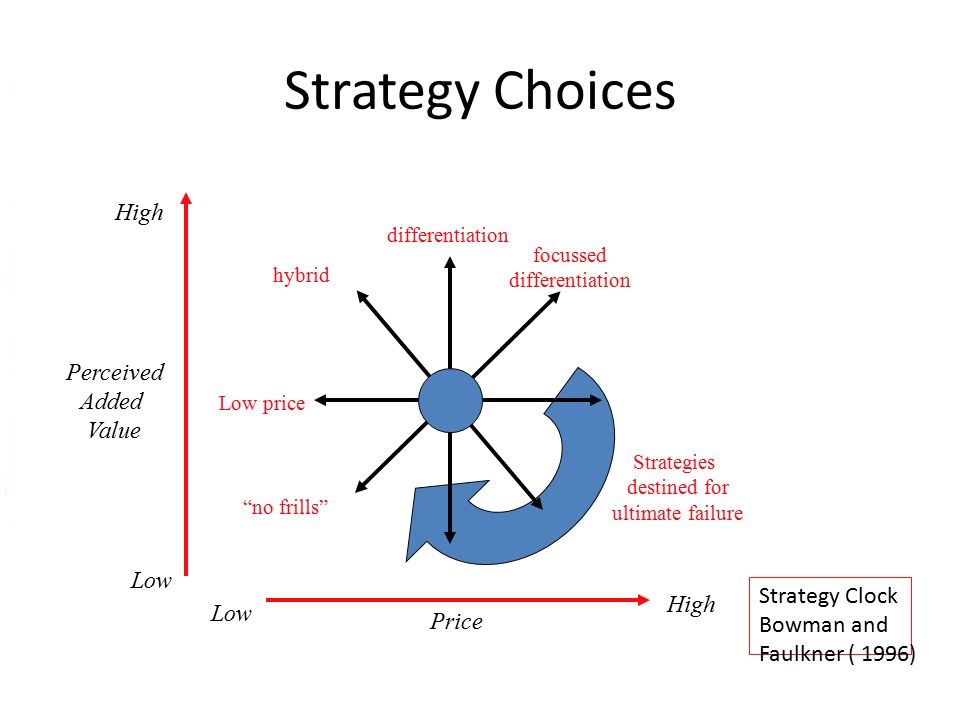

Bowman’s strategy clock model is the corporate strategy model that explains the cost and perceived value combinations many firms use and identifies the likelihood of success for each strategy.

The Bowman Strategy Clock or Bowman’s Strategy Clock is a strategic positioning model with which a firm can analyze its strategic market position in relation to what its competitors have to offer.

Bowmans Strategy Clock was first developed by economists Cliff Bowman and David Faulkner. According to Bowman, competitive advantage is more powerful as a distinctive element than a cost advantage; and it concerns strategic positioning and the positioning of a product in the marketplace.

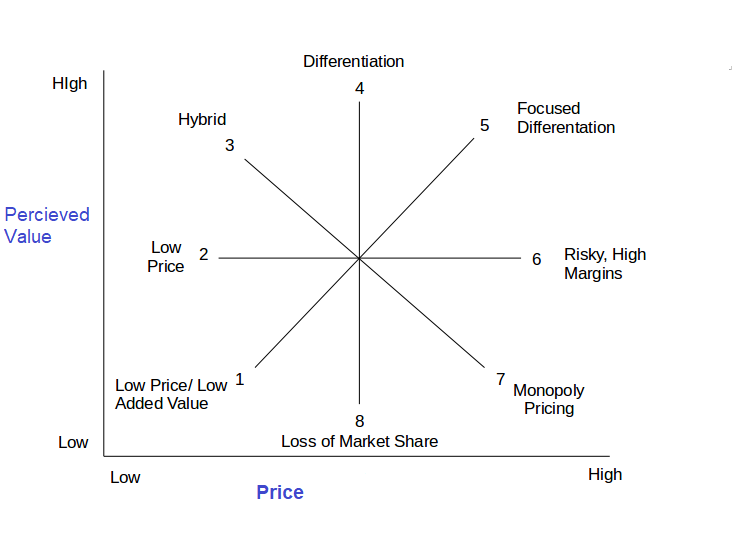

Visually, the Bowman strategy clock is often presented in the figure below.

With the price on the x-axis; ranged between low cost and high price and on the y axis, we have the perceived value as perceived by the customer. Again, the range here is notionally from low to high on the clock presents eight positions, eight combinations of price and perceived value and gives us some advice on each of those positions.

Low Price and Low Value Added

This is the “bargain basement ” bin, and not a lot of companies want to be in this position. Companies find themselves forced to compete in this position because their product lacks any differentiated value.

The only way to make it or to be successful here is true cost-effectively selling a high volume of products and continually attracting new customers.

Bowman said that some firms take up what he referred to as a low price, low-value position. These are firms that are charging rock bottom prices for what they sell, but they are selling what we know what we refer to as inferior goods.

Products are inferior, but the prices are attractive enough to convince consumers to try them. However, consumers might turn away from these products as their incomes start to grow.

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

The position relies on the absolute economies of scale to drive down unit cost. This is a very difficult strategy to make work because the profit margins per sale are quite slender because of the low price that they are charging.

Low Price and Low-Value Added Examples

Examples like pound stores, for example. They charge very low prices, and consumers know that what they’re selling there is quite low value. It is a strategy that could work particularly advantageous at certain points in the economic cycle, but the key is economies of scale.

Low Price and Medium Perceived Value Added

This position companies competing in this category are low-cost leaders. These companies drive prices down to bare minimums on their balance, with very low margins with very high volume.

Bowman Strategic clock is just a regular low-price strategy, charging incredibly low prices and aiming to be the lowest price firm in the marketplace by selling regular goods that consumers may continue to buy even as we move through different stages of the economic cycle.

The company is trying to take up the position of being the lowest priced firm in that industry, to be cost leaders.

If low-cost leaders have large enough volume or strong strategic reasons for their position, they can sustain this approach and become a powerful force in the marketplace.

If they don’t, they can trigger price wars that only benefit consumers as the prices are unsustainable over anything but the shortest of terms.

It requires having a very high volume of sales because the profit margins per sale are quite small. Unless it can drive down those unit costs by finding a way of reducing the unit costs of production again, this could be a challenging strategy to make work.

Low Price Strategy Company Examples

Wal Mart is a key example of a low price competitor that persuades suppliers to enter the low price arena with the promise of too high volumes of activity.

Bowman’s Strategy Clock Hybrid (Low Price & High Perceived Value Added

The hybrid position offers products at a low cost but offers higher perceived value than those of other low-cost competitors.

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

Hybrid companies build a reputation of offering fair prices for reasonable goods. Bowman said that this is a strategic position that can work because some consumers want to feel like they are striving beyond just purchasing from the lowest-cost firm in that market.

Bowman pointed out that this is actually a strategy that could attract customers. Those that are slightly more aspirational and looking for slightly more value than the first two positions might provide us with but are not looking to pay the highest prices for that privilege.

Hybrid Strategy Company Examples

Examples of hybrid strategy companies that pursue this strategy are discount department stores. The quality and value are good, and the consumer is assured of reasonable prices, building customer loyalty.

Bowman’s Strategy Clock Differentiation ( Mid-Range Price & High Perceived Added Value)

Companies that differentiate offer their customers high perceived value. To afford the differentiated companies, either increase their price and sustain themselves to higher margins or keep their prices low and seek greater market share.

Branding is important with differentiation strategies, as it allows a company to become synonymous with quality and price point.

Consumers are willing to pay higher prices to purchase from the firm that’s got the stronger brand name in the industry on again.

As Michael Porter, Bowman says, this is a perfectly plausible strategy. There are going to be consumers out there that are going to be willing to pay more if you confined that selling proposition that they value more highly, so it could be the brand name, could be things like customer service, it could be things like delivery times…

Differentiation Companies Example

Nike is known for high quality and premium prices, and reebok is also a strong brand, but it provides high value with a lower premium.

Differentiation Focus (Higher prices & Perceived High Quality/Value )

This is referred to as focused differentiation, where we have high perceived value and higher prices. Consumers will buy in this category based on perceived value alone. The product does not necessarily have to have any more real value, but the perception of value is enough to charge very large premiums.

This is the opportunity for organizations to be charging much higher prices when targeting a niche and meeting consumers’ needs more specifically.

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

Again, when you’re in a marketplace where there may be fewer competitors that can meet that niche’s needs.

You might have a lower sales volume because you’re in a niche market place, but you can create that greater added value.

Differentiation Focus Company Examples

Examples we have companies like Gucci, Armani, Rolls Royce, highly targeted markets on high margins of the ways these companies survive.

Bowman also brought to the table three further strategies that he’d seen firms adopting. But each of these strategies, at least in the long run, will probably be unsuccessful if firms continue to take them up. The strategies are;

Risky, High Margins (High Price & Average Perceived Value)

Sometimes companies increased their prices without any increase to the value side of the equation, and when the price increases are accepted, the company’s enjoy higher profitability.

However, when it isn’t, their share of the market plummets until they make an adjustment to their price or value.

In the model, Bowman noticed that some firms charging higher prices for products while only offering a modest amount of value. They may have some form of differentiation to them, but really not sufficient to warrant the high prices that were being charged, and what Bowman said was that this was probably a result of businesses making marketing mistakes.

This mistake may be they’ve launched new products onto the market. They thought those products would be perceived as having greater value than they actually have, and so they’ve launched it with a higher price, but that strategy has actually been an error. While it may experience some success in the shorter term before consumers realized that the value being offered by this product is not as great as perhaps marketed, in the longer run, this is going to be a difficult strategy to make work.

It can actually lead to quite high-profit margins per sale in the short run because they are selling at a high price. Maybe if those benefits are only mid-value, this product has not been the most expensive to produce a manufacturer.

But as soon as the market as a whole begins to tweak that this is a product not really offering the benefits that may have been promised, they will lose sales and market share. The firm may need to think about changing this strategy to one of the others on the strategic clock.

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

Therefore, this strategy may work in the short term, but it is not a long-term proposition, as unjustified price premium will soon be discovered in a very competitive marketplace.

Monopoly Pricing (High Pricing & Low Perceived Added Value)

It is very difficult to sustain because you charge a high price for your product, and its value is incredibly low. This is classic monopoly pricing in a market where only one company offers the goods or services.

The monopolist does not have to be concerned about adding value because customers need what they offer and will pay the price.

Already, that sounds like a strategy or strategic position that’s just not going to work. Consumers will not pay a premium price for a good or a service that is only offering them the most modest forms of value.

According to Bowman, the only real situation where this strategy could be effective is if a firm finds itself in a monopoly and it really wants to exploit or take advantage of consumers.

In certain monopolies where a firm finds itself as the only producer of that good or service, they may be able to get away with charging a higher price for a good or service that really doesn’t offer a great deal of value.

But because consumers are not blessed with the luxury of choice, they have to continue to purchase from that firm because they are in a monopoly position, and they are exploiting their monopoly power for their own profit incentives.

But still, unless you’re in that monopoly position, it is a really difficult strategy for the strategy to work. Fortunately for consumers in a market economy, monopolies do not last very long.

Medium Prices & Low Perceived Value

This is a low value at a standard price. The company offers customers very little value but is trying to position the prices at the middle range of the market.

If they are charging more than rivals but offering no more value than they charge, then again, in the longer term, this is just not going to be a strategic position that firms are going to be able to use.

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

Because customers will realize that they are charging more than rivals are for a product that’s offering no greater value.

A company that pursues this type of strategy will lose market share.

Bowman Strategy Clock and Porter Generic Strategy

Michael Porter developed a strategy known as Porter’s Generic strategies, which set out what we refer to as the strategic positioning options for organizations. Porter said there are only two different positions firms can take up in the marketplace to be successful.

They’ve either got to be the lowest-cost producer in that marketplace. They drive down costs and passed on to consumers in the form of lower prices, and they could be successful.

They can also adopt differentiated in their business by offering consumers some value that they’re prepared to pay more than they would pay the low-cost producer in that marketplace.

Those are the two strategic positions you could take up being a low-cost producer or differentiating yourself somehow.

Porter noted that firms have got to be wary of is becoming what is known as stuck in the middle, falling between those two strategies, which he saw as the route to being unsuccessful.

But Bowman saw those two generic strategies as a little bit limited as a little bit restrictive for firms in their strategic positioning. He then developed a strategic clock made up of eight different strategies that he thought firms could utilize.

He developed some strategic positions to the table, which he believed could be successful and profitable, which Porter had advised firms not to take up.

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

Porter and Bowman Strategies

Slightly different Porter strategy, Porter said. If you become stuck in the middle, then that’s probably going to lead your business, not maximizing success.

Bowman’s actually set out more of a spectrum of strategic positions that firms can take upon. It gives organizations and gives managers a greater degree of choice in the strategic positions that they might choose for their organization.

Advantages and Disadvantages /Criticism of Bowmans Strategy Clock

The advantages of Bowman’s Strategy Clock include:

The advantages of Bowman’s Strategy Clock include:

- Bowman’s strategy is flexible and broad compared to the two generic strategies, which are a little bit limited and restrictive for firms in their strategic positioning.

- Bowman’s Strategy Clock is quite simple to analyze and understand

- Bowman’s Strategy Clock provides a range of starting points to design a strategy.

- Bowman’s Strategy Clock is practical and comprehensive than some alternatives.

Disadvantages of Bowman’s Strategy Clock?

The disadvantages/criticism of Bowman’s Strategy Clock include:

- Bowman’s strategy does not capture firms that are in a number of strategic positions.