Definition & Tradable Pollution Permits System Examples

Tradable Pollution Permits

Tradable pollution permits refer to a system of pollution control. An entity can trade its emission credits, from either a clean-air or clean-water regulation, with other companies. This is an alternative to traditional output-limiting regulations like command-and-control emissions standards and performance standards.

Tradable pollution permits, also known as cap and trade schemes, are a regulatory strategy used by companies to reduce their carbon pollution. The idea is that companies will reduce their emissions of greenhouse gases by investing in less polluting activities.

The idea behind tradable permits is that it could lead to more efficient firms lowering (or eliminating) emissions without the need for government oversight or enforcement by regulators.

Tradable pollution permits were first proposed by some of the earliest environmental economists, including Robert Mendelsohn.

Pollution of the Environment

Pollution is a major problem that the world is facing today. Pollution not only harms the environment but also affects human health. The greatest contributor to the pollution problem is the energy sector. Companies use fossil fuels such as coal, oil, and natural gas for energy production. These fuels release pollutants that can be harmful to human health and the environment.

To combat this problem, many governments have enacted policies that regulate industrial and other economic activity to reduce an entity’s emissions of pollutants into the atmosphere.

Pollution permits are a way to reduce the amount of pollution that companies release.

Tradable Pollution Permits Pros & Cons

Many people see tradeable permits as a way to reduce emissions without any negative unintended consequences.

Others feel that tradable permits are dangerous for the economy and could lead to monopolies and higher prices, especially in industries where current technology is not ready yet to reduce emissions without government oversight.

The main argument of opponents of tradeable pollution permits is that they can reduce marginal abatement costs by reducing the cost-value ratio, rate of return that investors place on alternative investment opportunities. When a company lowers its marginal abatement costs, it becomes less profitable for companies to invest in emissions reduction alternatives. Therefore, this could lead to fewer alternative investment opportunities.

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

A related argument against tradable pollution permits is that they would create an uneven playing field between old and new technologies and development methods. As the cost of emission control increases, the current technology becomes less competitive due to the additional cost burden. Therefore, it is highly likely that the more advanced new technologies would be less developed or would not occur at all than they otherwise would have been in the absence of tradable permits.

When tradable pollution permits are used in international markets, they can be viewed as a form of subsidy or tax. The use of tradable pollution permits is a form of emission control and does provide CO2 capture for some companies, which is commonly known as a carbon credit.

However, many tradeable emission advocates believe that the trade between CO2 emission rights and tradable permits provides an incentive to bring new technologies into the market. For example, tradable permits might be traded as a form of insurance against future environmental regulations.

Many supporters of tradable pollution permits, including the World Bank and the European Commission, believe that tradable pollution permits can greatly impact CO2 emissions. Tradable pollution permits could, over time, become the main strategy for reducing emissions and controlling climate change.

Today, tradable pollution permits are very popular in the regulatory field, and tradable permits will likely become more widespread in future environmental regulations as well.

Tradable Pollution Permits Criticisms

Tradable pollution permits have their critics, however. One common criticism is that tradable pollution permits would not work in certain situations, such as where the pollution emitted is a non-point source and diffusive. An example of such a situation is when the pollutants are CO and NO, which are produced by natural sources.

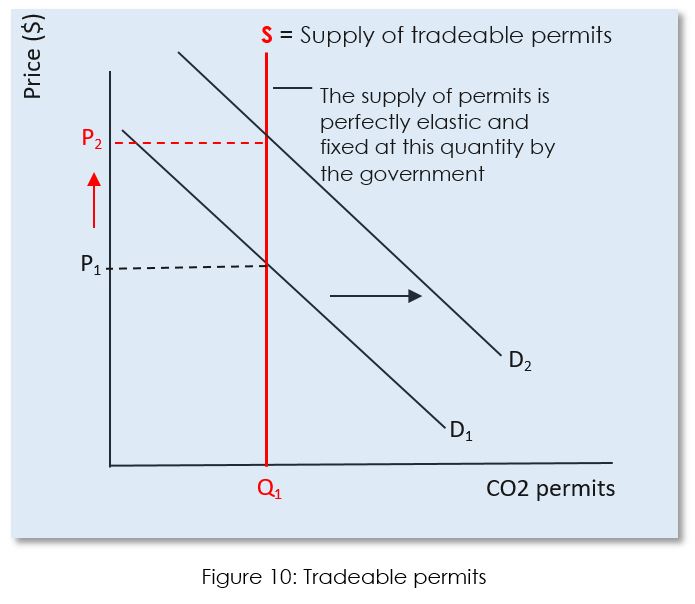

Tradable Pollution Permits Diagram

To combat the problem of pollution, many countries have instituted a system where companies can purchase and trade permits that allow them to pollute up to a certain level. The idea is that by giving companies the ability to buy more or fewer permits depending on their needs, they will be able to reduce emissions intelligently.

A tradable permit allows the company to emit a certain amount of pollution and that, if unused or only partially used, can be sold to another polluter.

The market is determining the permits’ price, the quantity supplied is being set by the government. When more firms want to pollute, demand will increase for the tradable permits, which will make the price go up. As indicated in the Tradable permits Graph below, the price will move from P1 to P2.

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

Example of Tradable Pollution Permits

The idea of Tradable Pollution Permits is that instead of giving companies the rights to pollute, they buy and sell them. This way, a company can only emit as much pollution as it has permits for. It also creates an incentive for companies to reduce their emissions by buying more permits or trading with other companies.

For example, governments may require that each factory must maintain a certain level of emission rates or face penalties if it emits more than allowed under its permit.”

How do pollution permits help to reduce pollution?

Tradable pollution permits are a type of cap and trade system that limits the number of emissions for companies and permits them to emit. The idea is that if you have more than your allotment, you can buy an extra one from someone who doesn’t need theirs.

Origin of tradable permit system

Tradable pollution permits have had many applications over the years. The vast majority of the applications have been in wastewater regulation. One of the first papers about a tradable pollution permit system was published in 1992 by John R. MacKenzie and William M. Tucker. This article was entitled “Trading Pollution Permits: An Environmentally Optimal Policy.”

The paper built on the idea that there is more value to reducing pollution than just putting a cap on it. The paper suggested that it could be economically beneficial for firms to lower their emissions below the cap. Under a tradable pollution permit system, a firm would want to reduce its emissions in order to sell extra credits to other firms. The more a firm could lower its emissions, the more credit it could then sell to other firms.

Disadvantages of tradable pollution permits

Tradable pollution permits are a type of emissions permit that is traded in the market. They allow companies who exceed their limit to buy permits from another company that has not used all of theirs. This system can be problematic because it may increase overall pollution levels, especially if one company buys more than they need and sells them on the open market.

The main disadvantage of tradable permits is that they do not limit how many someone can purchase or sell, which means there’s no way to tell what the outcome will be until after trading takes place.

Another downside is that some companies could end up with too many tradable pollution permits while others don’t have enough; this disparity could encourage some people to

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.