Advantages and Disadvantages of VRIO Framework | VRIO Analysis Example

What are VRIO Framework and Concept Resource and Capabilities?

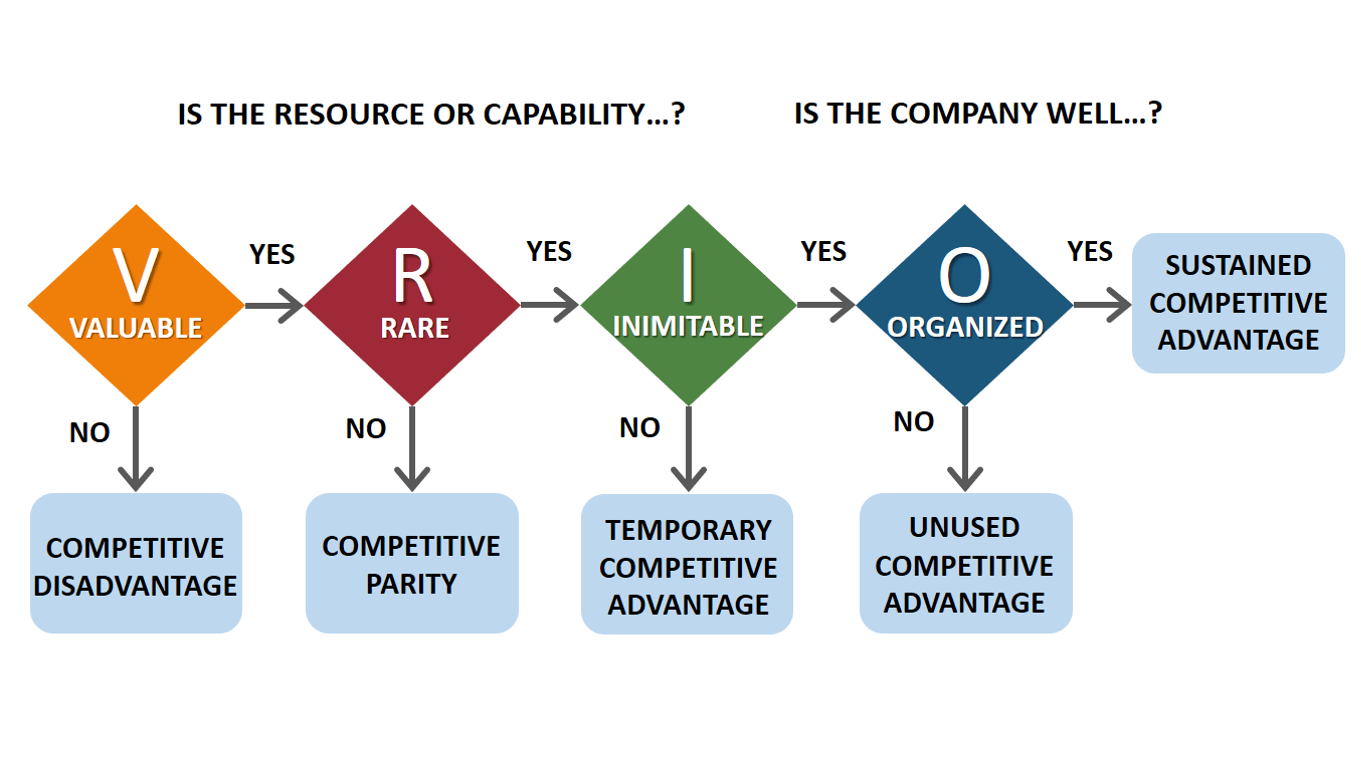

Resource and capability analysis is a powerful tool for uncovering resources and capabilities within the organization to give it a sustainable competitive advantage. VRIO analysis is strategic planning and business decisions tool that provides information and the results that give the firm a competitive advantage.

The VRIO framework and concept resource are two concepts that were to help with business strategy. Essentially, the VRIO framework provides a way to evaluate if something is valuable or not in relation to your company’s bottom line.

VRIO analysis model is a resource-based view of firms’ strategy and was developed by Jay Barney, who suggested that resources and capabilities are the key drivers of a sustained competitive advantage and greater profitability.

Tools such as Porter’s Five forces are helpful for understanding industry profitability. However, economic performance is about looking at the external environment and a firm’s internal environment.

The main objective of the strategy is to create a sustained competitive advantage.

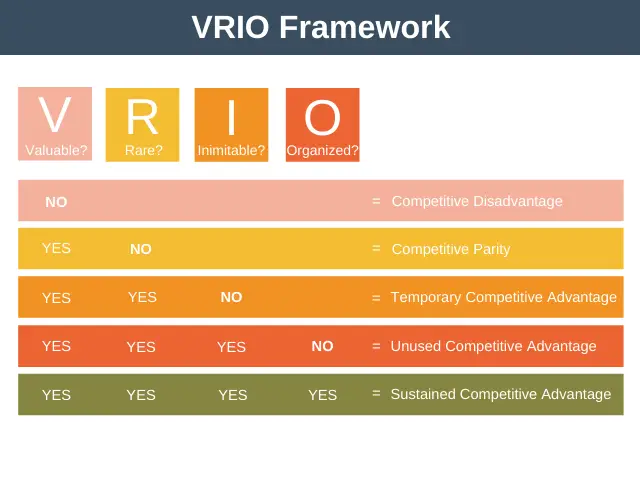

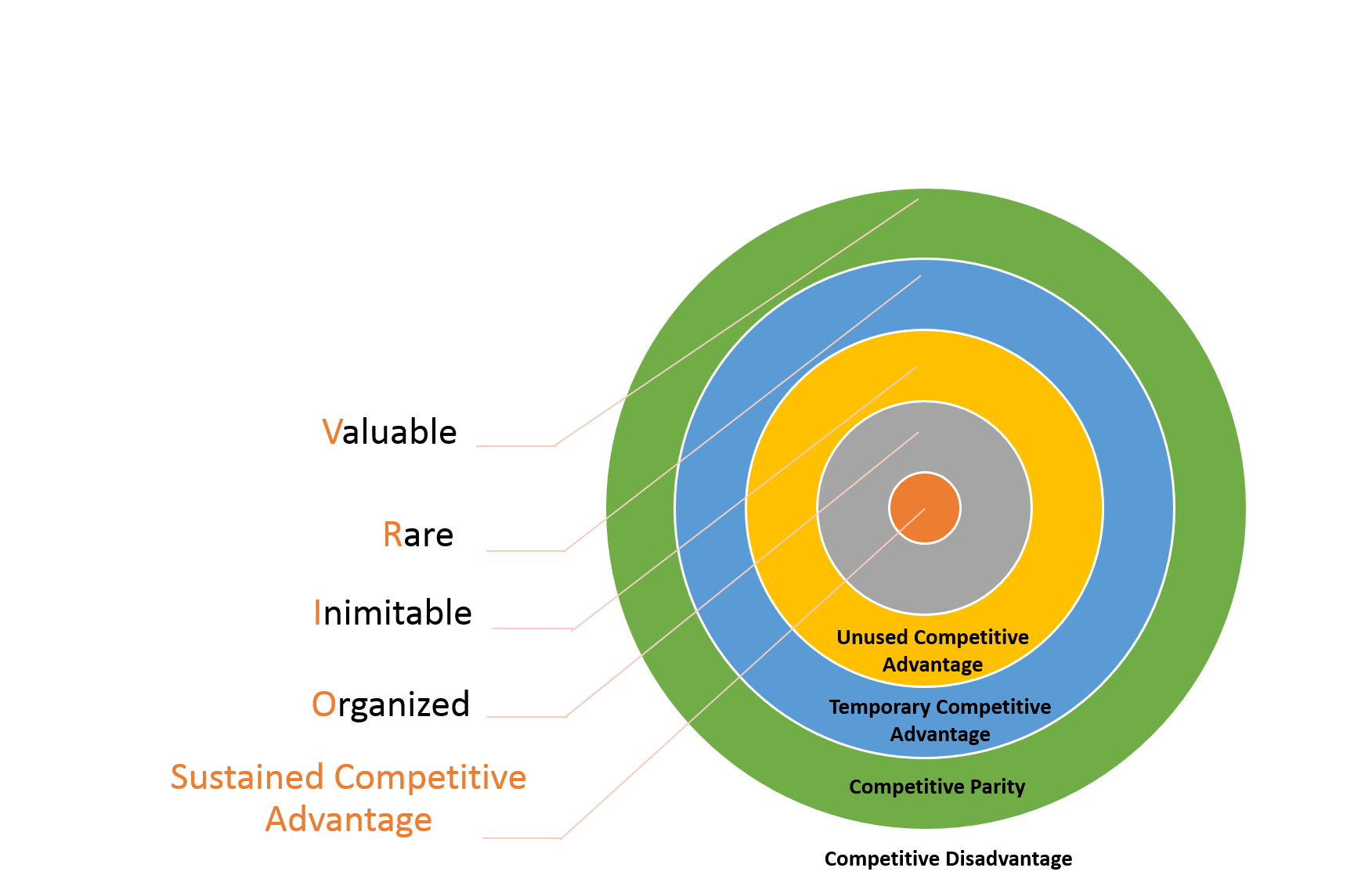

As mentioned earlier, a firm’s resources and capabilities are the key drivers of a sustained competitive advantage, and so these resources and capabilities need to satisfy four key characteristics.

VRIO stands for:

- Valuable

- Rarity

- Imitability

- Organized

Valuable

It needs to be valuable, rare, imperfectly immutable and organizationally exploited.

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

An Organization’s resources and capability need to add value to create a stain competitive advantage. The main objective is to increase efficiency; for example, a new IT system is valuable since it increases efficiency by increasing the number of calls an agent can answer.

The second objective is to increase effectiveness; for example, opening a new regional campus increases effectiveness and enables outreach to students’ new markets.

Rare

Resources and capabilities need to be valuable and rare to lead to a sustained competitive advantage. If a valuable resource or capability is common and shared by many firms, it will not lead to a sustained competitive advantage but rather a competitive parity.

Imperfectly Immutable

A firm’s resources and capabilities also need to be imperfectly immutable. If competitors have difficulty copying, these resources then firms are able to obtain a temporary competitive advantage.

Four factors could also make something entirely immutable.

- Due to uniqueness by nature and legal right, for example, patents.

- Due to historical conditions, for example, a resource obtained or developed due to a historical event could not be recreated or obtained over time.

- Causal ambiguity, which refers to a firm’s unclear understanding of why the resource is created value and

- Social complexity, which results from trust, informal and interpersonal relationships, and culture.

Having resources and capabilities that work together makes it more difficult to be copied so that a firm can attain a temporary competitive advantage.

Organizationally Exploited

This is the ability to be the organization we exploited. This refers to different abilities to exploit the full competitive potential of a resource or capability.

For the firm to exploit a resource or capability, it needs to have its strategy, structure, and processes aligned to give its people an incentive to exploit the firm strategy.

A firm’s analysis of its internal environment is as important as the external environment.

We can see that resources and capabilities are the key drivers of a sustained competitive advantage and economic performance.

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

For example, Coca-Cola has a secret recipe for their beverage products that provide sustained competitive advantage as the company is organized to take advantage of it. This product recipe is a highly guarded secret, and the other companies globally cannot copy it.

Therefore, it is important to understand the four VRIO characteristics, which help firms obtain a sustained competitive advantage.

VRIO Analysis Example

VRIO Analysis of Apple

Apple’s business is currently focused on consumer electronics and online/digital products, which are the primary revenue sources.

Core competencies help Apple company maintains its competitive advantage despite industry competition and internal issues in the organization. Apple’s sustainable competencies offer long-term competitive advantages that the company uses to ensure a profitable future while addressing current problems.

For instance, the company uses its brand and capacity for rapid innovation to maintain competitiveness despite the aggressiveness of Samsung, Huawei, and LG, among other consumer electronics manufacturers. This Apple VRIO analysis also shifts attention to business diversification and possible strategic changes for long-term competitiveness based on technological innovation.

Again, Apple’s strategic plans already include significant opportunities to develop the business in other industries or markets. This includes robotic and artificial intelligence markets gaining ground and the autonomous and self-driving automobile markets.

Apple’s Organizational Resources & Capabilities |

V | R | I | O |

| – Business process automation | ✔ | |||

| – Competitive employee compensation packages | ✔ | ✔ | ||

| – Human resource capabilities for innovation | ✔ | ✔ | ||

| – Product mix diversity | ✔ | ✔ | ✔ | |

| Sustained (Long-Term) Competitive Advantage(s): | ||||

| – Globally popular premium brand | ✔ | ✔ | ✔ | ✔ |

| – Systems set up for rapid innovation | ✔ | ✔ | ✔ | ✔ |

| – Ecosystem of complementary products | ✔ | ✔ | ✔ | ✔ |

| – Access to user information | ✔ | ✔ | ✔ | ✔ |

| – Artificial intelligence capabilities | ✔ | ✔ | ✔ | ✔ |

| – Global distribution and sales network | ✔ | ✔ | ✔ | ✔ |

Advantages and Disadvantages of VRIO Framework

Advantages of VRIO Framework

These are the advantages of VRIO Framework;

- VRIO Framework can help the firm identify unused competitive advantages to transform into a sustained competitive advantage.

- VRIO framework is a tool for analyzing the relative importance of different business activities. The VRIO framework is a useful tool for understanding the relative importance of different business activities. It helps managers understand which activities are more important than others.

- It can also be used to identify and rank potential opportunities and threats to determine which ones are most important.

- The VRIO framework helps managers make decisions about resource allocation by identifying those areas that offer the greatest potential return on investment (ROI).

- This model also provides a way for companies to prioritize their efforts, thereby increasing efficiency and decreasing costs.

Limitations of VRIO Framework / Disadvantages of VRIO Framework

The following are some Limitation of VRIO framework/ disadvantages of the VRIO framework:

- The business environment in which firms operate is constantly changing, and it means that it could be very difficult to be on the achieving end of a sustainable competitive advantage. The best the firm can do is to have a competitive advantage only for the foreseeable future.

- It may not be easy to apply the VRIO framework to smaller businesses that are just startups. They might not have enough resources or capabilities to identify any sustained competitive advantage.

- The VRIO framework doesn’t factor in internal factors, for example, how demand in the marketplace is shifting and changing. It does not take into account all factors that could affect the organization’s performance. The VRIO framework is not a widely-used concept. With the VRIO framework, it can be difficult to measure the performance of each component in isolation.

- There are many different ways to calculate the value of an asset, and it can be hard to determine which one is most appropriate for your situation.

- The VRIO framework can be difficult to use in practice.