Economies of Scale Examples

Economies of Scale

What are Economies of Scale?

Economies of scale refer to a firm’s cost advantage when it increases its output level. Economies of scale occur when inefficiencies are reduced as production levels increase. Typically, economies of scale result from a reduction in unit costs due to the size of the firm.

The term economies of scale originate from the assumption that large-scale production has lower per-unit costs than small-scale production. This is because costs are inversely related to production quantities, so economies of scale represent a geometric relationship between input and output.

Marketing economies of scale are evident in the current era. The theory of marketing economies of scale is one of the most important concepts for understanding pricing behavior in any marketplace. It is a significant factor to consider when analyzing the behavior of profit margins among different sellers in the same industry.

This theory holds that a larger firm, group of firms or industry earns lower per-unit average costs than a smaller firm, group of firms or industry. In general, this is because larger firms can spread overhead costs over a greater dollar output level and thus lower the total costs per unit.

The concept of marketing economies of scale states that a firm’s growth depended on the extent to which it can reduce per-unit costs. In addition to the direct production costs, firms also incur unnecessary expenses from inefficiencies in production and distribution.

One of the primary sources for the theory is the experience curve. Firms with more experience in production and delivery can be expected to reduce costs over time, resulting in lower average costs. As firms replicate processes, they learn from past mistakes, refine certain aspects, and eliminate unnecessary duplication by focusing on core competencies.

Economies of Scale in Oligopolistic Market

It is important to note that the concept of economies of scale is more significant in an oligopolistic market, as opposed to a perfectly competitive market. This is because firms have the ability to influence costs through strategic pricing and that consumers do not have as much power in influencing prices.

The size of a firm also has a direct effect on production efficiency. Larger firms can spread overhead costs over a greater output level, lowering per-unit costs. This is particularly true for firms that have a high degree of vertical integration in production and distribution.

Vertical integration allows firms to eliminate the costs associated with having third parties as intermediaries by taking on those functions themselves. The same is true of factors such as economies of scope, which refer to the concept that a firm that offers multiple products or services may realize lower per-unit costs due to specialization.

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

The exact relationship between economies of scale and per-unit costs is not linear but rather “S” shaped. Until a certain level of output is reached, size increases result in higher per-unit costs. At this point, a firm enters the range of economies of scale and can expect to realize lower per-unit costs. After a certain output level is reached, per unit costs begin to rise again due to a phenomenon known as diseconomies of scale.

Economies of scale are the opposite of diseconomies of size. The two concepts explain the same phenomenon in just opposite ways. Economies of scale, also known as internal economies of scale, describe a firm’s decrease in per-unit costs as production increases. Diseconomies pertain to a decrease in output associated with increased production due to diseconomies generated by growing large.

Economies of scale, also called “economies of production,” relate to a business’s cost principles. To use an example, the more cars you manufacture, the higher your economies of scale. For example, a large trucking company might have lower per-ton costs than a small trucking company because it buys bigger rigs and can buy insurance for all its trucks at better rates through its buying power.

Therefore, at this scale of operation, the benefits of economies of scale outweigh the opportunity costs.

Economies of Scale and Scope

Economies of scale also commonly occur in vertical industries where product size or production runs are too small to have economies of scale. Small producers will not enjoy the economies of scale that larger producers can access, and they would not benefit from any size effects that occur when they try to break into a market.

Simultaneously, changes in the costs of inputs may also occur, leading to sometimes disparate results. Two of the most commonly cited examples are;

- Economies of scale due to learning curves: the more a firm produces before achieving its minimum efficient scale, the lower per-unit costs it experiences.

- Economies of scope occur when fixed costs are spread over more units of output or higher sales revenues.

Some industries are characterized by dramatic size changes as new products are introduced, and the number of customers (and hence total sales volume) increases. In other industries, a firm’s size is fairly stable, and the product may not be dramatically improved in new versions or variations.

In these cases, economies of scale are said to be limited or absent. Industries that exhibit high growth rates may see a high rate of innovation but limited economies of scale. The result is that production volume increases quickly, but unit costs do not fall as quickly.

Product size has two dimensions.

- First, product size refers to the width of the product or service itself. It is usually measured in the number of items, such as toothbrushes, inkjet printers, hot tubs (or spas), and suburban homes.

- Second, there may be variations in product size that are due to changes in manufacturing technology and/or design.

For example, with technological advances, smaller car engines have become available with lower initial entry prices, which have led to lower unit costs per vehicle sold. Increasingly, consumers are willing to trade off their electric cars’ speed in favor of more passenger rooms.

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

As a result, when a car company launches an electric car model, it may sell only a small number until it scales up its production capabilities.

Economies of Scale Example

Economies of scale in a manufacturing setting often work with the idea of diminishing returns. The larger the firm is, the more stuff it can produce. Because it takes more time and effort to produce a larger quantity of items, there is also an increase in cost.

For example, if a manufacturer doubles the number of items he produces and increases unit costs by 10%, then he will sell two units for every one unit that he sells previously. Therefore, his unit return decreases. He does not make as much money on the additional units because he spends more money to produce them than he would have spent to produce fewer units.

Another example of economy of scale in the case of an application server. High volume companies will distribute the load across multiple, highly tuned servers rather than one large server. This leads to significant cost savings for a company when scaling up.

Cost-sharing arrangements are an example of economies of scale. They occur when two or more businesses join to share in the fixed costs of producing something they all need (for example, to share in the cost of advertising).

Another example of economies of scale is when a company sells very similar products. This means that the product can be replicated more cheaply, which results in a lower price per unit. This means that for every extra unit the company sells, it makes more money since it spends less to make each individual product.

Economies of Scale in Pharmaceutical

Economies of scale can apply to many different fields, such as pharmaceutical development and medical equipment manufacturing. In many cases, a new product being created will require expensive research and development of prototypes and clinical trials. The more similar the finished product is to the same prototype, the more efficient R&D costs are.

Economies of Scale in Healthcare

The concept of economies of scale is often applied to large-scale production in the business sector but can also apply to other fields such as medicine.

For instance, the economies of scale for medicine are brought about by increasing numbers of people who need medical treatment. Large hospitals and medical centers have lower pre-treatment costs than smaller centers because they have more capacity to handle more patients before overran by waiting lists or new patients. A related concept in economics is called network effects.

The term network effects are used to describe the economies of scale in an internet (faster networking, more storage capacity, etc.). Economies of scale in health care are similar to the idea that hospitals should be large so that they can lower their per-patient costs. This will be discussed later on.

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

Economies of Scale in Production

Economies of scale are also present in industries where there is increased productivity and efficiency. For instance, a company with more capital assets (such as machinery, factories, etc., that are not used) can produce more goods and services than a company with fewer capital assets.

The example of the automobile industry is a clear example. When Henry Ford revolutionized automobile production, he did so by mass-producing his cars (so that each car could make several other cars in the same factory). This increased per-unit costs and enabled Ford to reduce his per-unit costs because he was making more cars and cut back on production overheads.

Economies of Scale in Business Sector

Economies of scale are also present in the production of products in the business sector. The main example of this is when a company can produce more goods per hour or day than it would be able to produce if it paid for workers to work longer hours. This happens because workers are not as productive at non-standard working hours.

Economies of Scale Petroleum Refining

The case of Standard Oil in the late 1800s provides us with evident proof of economies of scale. Standard Oil used its economies of scale to gain an advantage over competitors, increase product differentiation and become one of the most successful businesses in history. Standard Oil produced a wide range of products, including kerosene, fuel oil, lubricants, margarine, and many other goods in the petroleum industry market.

In 1879, Standard Oil’s CEO John D. Rockefeller took control of the company. To gain an advantage over his competitors and become one of the most successful businesses in history, Rockefeller expanded Standard Oil’s production for both kerosene and lubricants.

Through the use of economies of scale, Standard Oil increased its profits by reducing its per-unit costs. This meant that Standard Oil was able to produce more goods for less money. The fact that Standard Oil’s per-unit costs were being reduced did not make it likely that the prices consumers had to pay would also decrease. However, Standard Oil was determined to be successful and so continued on with their large-scale production processes. This helped Standard Oil maintain its competitive advantage over its competitors.

Standard Oil came to dominate the petroleum industry through the use of economies of scale. It expanded its production and used this to gain an advantage over its competitors.

In addition to expanding production, Standard Oil was also able to increase its product differentiation to become more successful than other businesses in its field.

Economies of Scale in Science, Technology and Innovation

Examples in the fields of science, technology, and innovation:

A famous example of economies of scale in the manufacturing sector was the Toyota Production System (TPS). Before TPS, Toyota produced many different models, and customers had to buy all of them. In contrast, with TPS produces one model for all its customers to choose from. This cuts down on production costs because suppliers can be hired only once.

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

It also eliminates preproduction costs by not having to test many different production models. This allows the TPS to be more efficient than its competitors. The TPS has saved Toyota more than US$1 billion in costs, and it has increased productivity dramatically, as evidenced by the increase of Toyota products sold worldwide. At the end of 2007, Toyota produced nearly 21% more cars than it did in 2000.

With economies of scale, final product prices decrease with increasing manufacturing output because of the law of constant returns to scale. If the output increases by a certain amount, it must be at the same level as the input.

The opportunity cost of using resources for other uses is often used in economics closely related to economies of scale. This is what must be given up when resources are used for one purpose instead of another and depends on how much use can be obtained from those resources.

Economies of Scale in Perfect and Monopolistic Markets

Economies of scale only apply in the market-driven model with perfect competition. Monopoly and monopsony (with the seller having a monopoly or controlling the market) allow for economies of scale by lowering the opportunity cost of production resources.

The Law of Diminishing Returns

The law of diminishing returns is another economic term related to economies of scale. If an input’s use increases, other inputs must decrease in order to achieve the same output. This says that as an input is used more, it becomes less effective in producing output. As workers are used more, they become less efficient at their work, and the same goes for supplies as well.

Advantages and Disadvantages of Economies of Scale

Advantages of Economies of Scale

Economies of scale have a lot of benefits for businesses. They allow for large firms to enter into an industry because they can afford to take the big risks required to set up a market. Through economies of scale, small businesses can grow into larger ones.

Additionally, economies of scale decrease production cost in the long run because more output is produced in a given period. This allows for the creation of a larger output that can then be sold at a lower price.

Technological progress may provide cheaper ways to produce goods. It will also be advantageous if the technical or legal environment provides greater protection of private property rights and lower taxes on production or if there is political stability that reduces social uncertainty.

Disadvantages of Economies of Scale

Economies of scale are beneficial for many businesses. However, they do have some drawbacks. In some industries, these benefits are not enough to make up for the high capital investments required in order to produce goods on a large scale. Sometimes it is better to stay fairly small and stay competitive.

There are also certain industries where specialization plays a big part. For example, there is very high variability in customer habits in the casino industry, and therefore, gambling strategies need to be developed for each customer type. In the gaming industry, it is very important to be able to find out and implement the best strategy for every individual client.

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

Additionally, economies of scale can also present some problems to enterprising firms. For example, as the technology used in production is improved, a firm will find that it must purchase more of the same technology to maintain the same production levels.

Other disadvantages of economies of scale include;

- Decreased Differentiation – Since it is difficult to produce different products when a company or industry is large, the products tend to be more similar because all of the companies are using a similar standard production process, therefore making differentiation of products more difficult.

- Hiring – When a business or industry operates on large amounts of capital, it can affect its hiring practices. Since the company needs to hire more people to fulfill its obligations, it may have to lower its hiring standards and hire additional employees that may not be as qualified or efficient.

- Based on Fixed Costs – Economies of scale are based on fixed costs.

- Fixed Costs – Fixed costs, such as land rent, insurance, etc., will increase when a business or industry grows larger because they are not directly linked to the production process itself. This increases per-unit costs as well.

- Reducing Profits – When a business or industry grows larger, it usually increases its fixed costs as well. This means that the company will operate on a lower profit margin and be unable to make as much money as it would if it had stuck with small-scale production.

The firm must make an investment that it knows will decrease its profit in the short term so long as it does not affect other aspects of its business model.

Another possible problem is that of sunk costs. For firms, sunk costs are fixed in the short term and may not have a long-term effect on their business or profitability.

Impact of Economies of Scale

There are several economic impacts attributed to economies of scale. The following is a list of some:

The most important impact is the reduction in average variable costs. As output increases, the average cost per unit decreases. This, in turn, reduces the amount of total fixed costs that a firm must invest in order to maintain stable profit levels. This leads to higher overall profits.

Economies of scale are also associated with increased productivity and higher efficiency. With economies of scale, firms will cut many expenses or reach more customers since the production scale and the organization becomes large and efficient. This is an interrelated definition because economies of scale also increase the firm’s ability to generate profits.

During mergers and acquisitions, businesses are more likely to purchase an organization with economies of scale. Since a large firm has more resources or money to invest in the acquisition it will have higher odds of buying the company.

This will result in using excess resources from one firm for future growth while still creating increased total revenue for both companies.

Internal and External Economies of Scale

Internal Economies of Scale

According to economic theory, economies of scale occur when the cost per unit decreases as production increases. This happens because as factories grow in size, they are able to take advantage of their increased volume discounts and more efficient use of employees, machinery, and materials.

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

Internal economies of scale can be because of technical improvements, managerial efficiency, financial ability, monopsony power, or access to large networks.

The theory implies that a firm will be able to produce more goods or services for the same fixed cost if it operates on a large scale. This is because of what economists call internal economies of scale: The larger the size of an operation (number of workers), the better is its “internal” efficiency and effectiveness (workers are close together, have common goals, etc.).

A firm’s ability to achieve economies of scale is determined by the extent of its own internal organization.

Internal economies of scale are a term used to describe the increase in efficiency that occurs when a company increases its production to an optimal level. The relationship is expressed as the production cost decreases per unit of output double compared with the costs involved in producing only a single unit of output.

Such economies are therefore comprised by using divisional or functional specialization and divisionalization.

Internal economies of scale include the savings that a company generates as a result of producing large quantities of goods. This is common in industries where there are high fixed costs and low marginal costs, such as oil refining. The result is that a company making large quantities of goods will get a lower price per unit than a company making small quantities of the same good.

But companies are not only competing with each other on their prices. They are also competing for customers. This is where economies of scale come into play: they provide an incentive to produce more in order to gain market share and, hence, higher sales and profits. This is achieved by lower prices and/or better products.

External Economies of Scale

“External economies of scale” emerge from benefits accruing to businesses because of their location.

Under conditions of external economies of scale, the firm can still benefit even if it is internally organized into sub-units or departments.

Economies of scale may be subject to diminishing returns; at some point, additional investment will decrease efficiency and increase costs. This is a particular problem for older businesses that have already invested in infrastructure and must continue investing in order to compete with newer businesses in the same market sector.

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

Companies in this situation are often very reluctant to make additional investments, as the marginal gains from such investments are usually relatively small. Besides, if the company does not continue investing in capital goods, its competitors will likely have this same advantage.

Types of Economies of Scale

Economies of scale are present in many types of businesses. Types of economies of scale include:

Economies of Scale by Industry

This is when a company or industry demands large production for products or services to be produced.

Economies of Scale at the Firm Level

This is when an individual business demands large amounts of production to lower costs and maintain higher productivity.

Economies of Scale at the Plant Level

This is when a business or multiple businesses share common facilities and resources to lower production costs.

There are two other types of economies of scale:

- The first is a “cost” advantage, which occurs when volume increases. This usually means the more you produce, the cheaper each unit becomes. For example, when a farmer plants more corn, each acre produces more corn. This actually happens over time, but it is equivalent to saying that the unit cost of production is lower in the short run.

- The second type of economies of scale refers to a productivity advantage. This means that the actual output of any one unit increases over time. This will happen more rapidly at the beginning, but it is equivalent to saying that the unit cost or per-unit cost of production decreases over a longer period of time.

Benefits of Economies of Scale

Benefits of economies of scale are:

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

- More Efficiency – A business can provide many more goods or services at a lower cost-per-unit.

- Increased Profits – When businesses or industries can mass-produce products, they can increase sales and revenues, which in turn leads to higher profits.

- Competitive Advantage – In order for a business to be able to sell its product, it must be affordable and competitive. If the firm is operating on a low-profit margin, it will be unable to sell its product. If the business is operating on a high-profit margin, the company can easily sell its product because it will be able to supply cheaper, lower-cost products to customers.

- Capturing New Markets – When a firm is able to reduce its per-unit costs, it can take advantage of new markets that it was previously unable to operate in.

- Economies of Scale are not Permanent – It is very important to note that economies of scale are not permanent. There is a point at which the per-unit costs will increase again because of fixed costs and increased capacity costs. This is often referred to as break-even.

- Decreased Time to Market – Since businesses can produce more goods or services at a lower cost, they can bring their product to market quicker. This decreases the time that it takes for them to be profitable.

- Increased Product Quality – When a business has more capital assets, it is able to produce safer and better-quality products because it has invested in additional machinery, technology, etc.

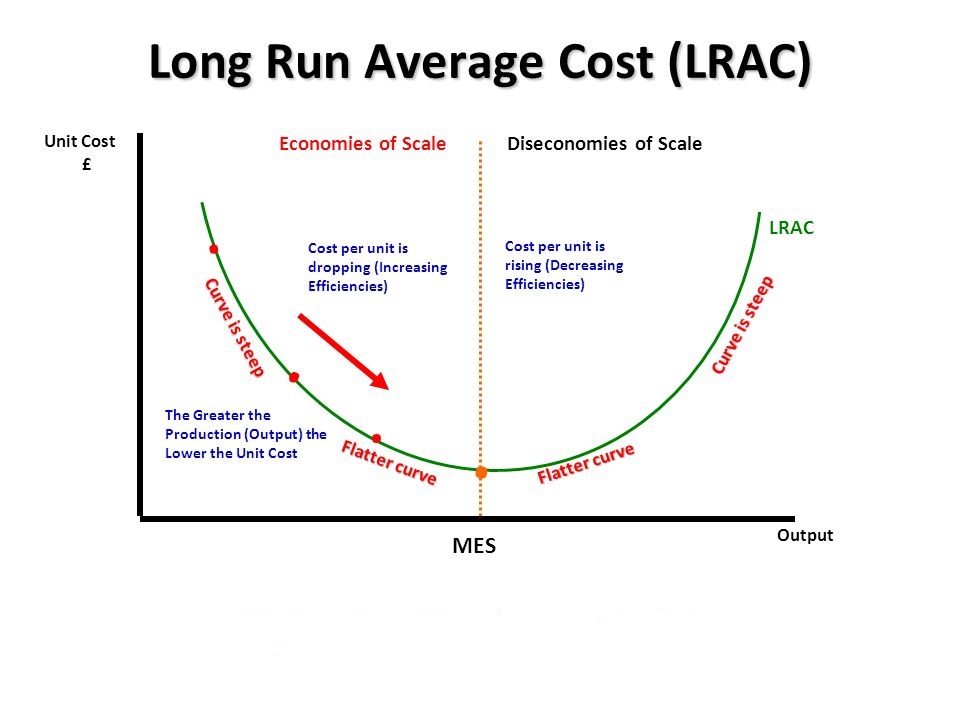

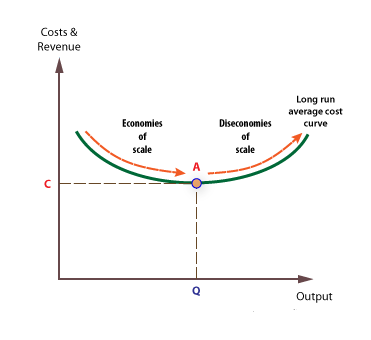

Long Run Average Cost Curve Economies of Scale

The long-run average cost curve is the name given to the U-shaped curve that indicates economies of scale. The curves in this set of graphs show different output levels at which firms experience decreasing profit per unit with increasing output. In each graph, on the horizontal axis, we have the number of firms operating in the industry, and on the vertical axis, we have a profit per firm.

The short-run average cost curve shows that there are many firms in the industry at low levels of output per firm. In this situation, firms are small relative to the market demand curve, facing a downward-sloping demand curve. Thus, a firm producing at the minimum point of its demand curve will earn a low profit. As output increases, firms continue to better their position on the market supply curve, which encourages new firms to enter the industry, thus increasing output.

In the long-run average cost curve for an industry, we see that there is only one firm operating in the industry at high output levels per firm (a large number of firms), and it is earning a high profit. The long-run average cost for this one producer is therefore high. This is due to economies of scale – the low average cost per unit associated with large firms.

The important point here is that the number of firms in the industry increases as output increases in exactly the same way as long-run average cost decreases (because there are more firms and hence more competition, which drives down prices).

However, as output continues to increase, above the point at which there is one firm, we see that firms start to incur diseconomies of scale – rising costs per unit with increased output. This is the point at which new firms stop entering the industry, and eventually, there is only one firm left.

Therefore, the long-run average cost curve shows that at low levels of output, there are high average costs per unit, but as output increases, firms experience economies of scale. However, as output continues to increase above where there is only one firm in the industry, diseconomies of scale occur, and average costs start to rise.

Economies of scale can be broken down into three views /categories:

Economies of Scale: the production costs for a unit are lowered as the total quantity increases. This is the most basic form of the economy of scale, and it is the easiest to understand.

Proportional economies of scale: Increases in the output result in increases in unit costs that are proportionately lower than the overall increase in output.

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

Increasing economies of scale: As production increases, unit costs decrease, but the decrease is not proportional to the output increase. This can be illustrated using a graph showing rising marginal costs and falling average total costs. An economy of scale exists where the average total cost curve slope is positive but less than one (the lower, the better). The precise point at which average costs begin to fall for an output range is the point at which economies of scale first set in. This type is rare today because a monopolist can only achieve it.

Marketing Economies of Scale

Companies’ ability to negotiate favorable prices grows as they make larger and larger transactions.

Example of Marketing economies of scale

Amazon, for example, may get lower shipping rates from distribution companies than a small business shipping out an occasional product. Bulk sales of raw materials are less costly than small-quantity purchases. The same is true for advertisement expenses such as television commercials and other forms of advertising. Larger corporations will usually command lower prices than smaller rivals.

Technological Economies of Scale

Technical economies are cost savings achieved by a company as it increases in size as a result of increased use of large-scale mechanical processes and machinery. Technical economies are possible in the case of a mass manufacturer of automobiles because they can use mass manufacturing methods and benefit from specialization and labor division. Technical economies are more likely when systems can be quickly scaled up.

Examples of Technological Economies of scale

Here are some examples of how economies of scale work: Technical economies of scale: Large-scale businesses can afford to invest in expensive and specialist capital machinery. For example, a supermarket chain such as Tesco or Sainsbury’s can invest in technology that improves stock control.

Financial Economies of Scale

Financial economies of scale mean that the business can obtain capital at a lower cost. An initial public offering (IPO) helps a larger company to raise capital from the stock market. Large corporations have better credit scores. As a result, they benefit from lower bond interest rates.

Financial economies of scale believe that as a firm grows, it becomes more efficient at producing its outputs. There are two lines of thought on this:

- The first states that as firms grow, they become able to produce more and or better goods at lower costs, so there is a benefit from increasing scale.

- The second says that as firms grow, they become able to produce more goods for the same price because larger firms have economies of scale.

Note:

Note that economies of scale often exist when average costs fall with rising output units, but this does not imply that diseconomies of scale do not exist. Diseconomies may arise because average fixed costs increase more than proportionately as output increases.

💥🎁 New Year & Easter Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.